- 17,264

- 27,199

- Joined

- Dec 15, 2012

some of you "Socialist" should actually read about da scandavanians broad tax.

*ahem*

How Scandinavian Countries Pay for Their Government Spending

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?taxfoundation.org

Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers. For example, in Denmark the top statutory personal income tax rate of 55.9 percent applies to all income over 1.3 times the average income. From the American perspective, this means that all income over $65,000 (1.3 times the average U.S. income of about $50,000) would be taxed at 55.9 percent.

Norway and Sweden have similarly flat income tax systems. Norway’s top personal tax rate of 38.4 percent applies to all income over 1.6 times the average Norwegian income. Sweden’s top personal tax rate of 57.1 percent applies to all income over 1.5 times the average national income.

In comparison, the United States levies its top personal income tax rate of 43.7 percent (federal and state combined) at 9.3 times the average U.S. income (around $500,000). Thus, a comparatively smaller share of taxpayers faces the top rate.

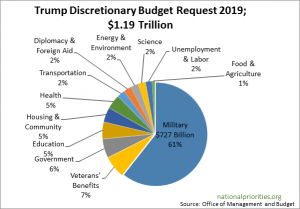

aka ish never working in America.

This information if factually incorrect. One, the top corporate rate from a federal perspective is 37%. Depending on the level of passive income individuals could be subject to a 3.8% NIIT on investment income in excess of $250k. The 37% rate starts at $612K for 2020 which means that people who make $10T a year, pay close to the same in tax as someone who makes $300K a year and pays tax at a 35% rate. Not to mention that income in excess of $138K in not subject to payroll taxes of 7.65% for SS and FICA. That means from a federal perspective that someone who makes $10T a year can effectively be paying income tax at 37.000000001057% combined with FICA and SS versus a couple who both make $138K a year for a combined $276K and would pay federal tax of approximately 28% (after factoring in the progressive tax rates) + the full FICA and SS tax of 7.65% for a total of 35.65%. Tell me in what world does it make sense that a couple someone making $276K year should be paying effectively the same federal tax rate as someone making $10T a year. When you can answer that you can talk about the federal tax code.

That is not a tax code that is progressive enough.