- 8,906

- 2,685

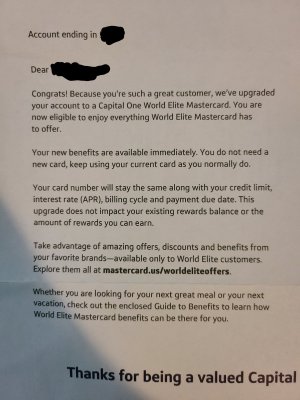

I had a capital one card

Pretty average, I think classic. No rewards. No nothing.

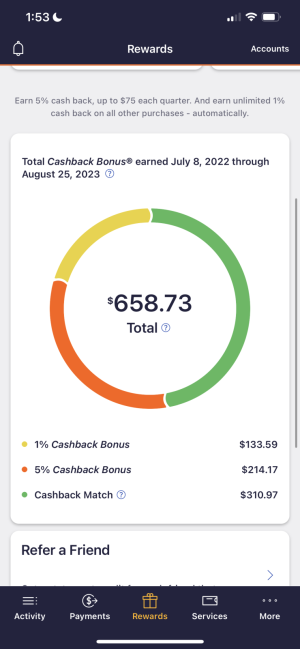

They sent me a letter in the mail asking me if I'd like to upgrade it to quick silver. Did it, now let's see how the perks work

Really arent any perks at all. Just the 1.5% cash back I think