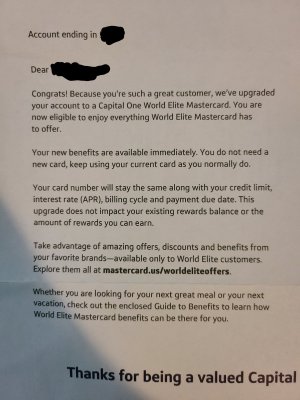

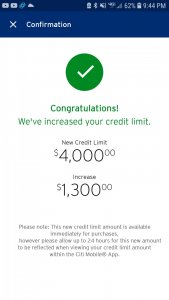

Got my Amex Every Day card last week with a limit 4x that of my Capital One Journey cards.

I really wanted the Blue Cash Everyday Card but got it confused with the Blue Cash Preferred and went with the basic Everyday Card. Only difference is instead cash back on the Blue card you get points on the basic with 2x points at grocery stores. Good if I want to do more of my own shopping. Plus an extra 20% points on all purchases (previous and future) for that billing cycle after your first 20 purchases which is cool. Only thing I'm missing out on is the $100 cash back after $1000 in purchases, but whatever.

I have about $400 between both my Journey cards to pay off and then I'm gonna start using my Amex for everything and just paying it off in full every month. Plan to have both paid off by next month and then I can say I'm officially debt free.