- 8,070

- 5,047

- Joined

- May 24, 2014

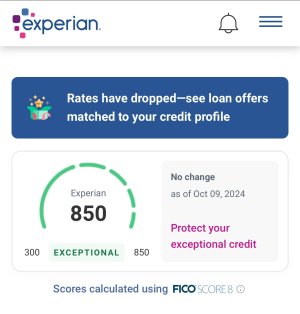

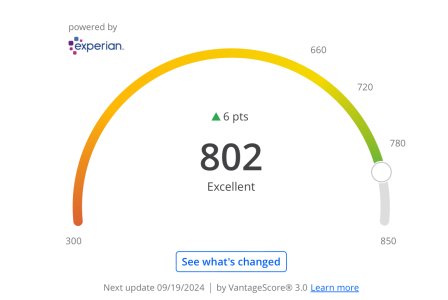

That's what I was guessing after I posted. I'll consider it for the future. My debt so far has been mostly self-inflicted with a lot of luxuries since I'm still so young, but this looks useful for the future.It lowers your credit utilization % but since you said you'd be debt free soon then it really doesn't matter in your case. Congrats.

And thank you. Knocked down over $2000 in debt this year so I'm excited to get it all over with. Just gonna keep throwing leftovers from my paychecks at my cards and continuing to safe, cutting out most of the fun stuff until it's taken care of.

Last edited: