- 4,758

- 1,409

- Joined

- Nov 6, 2012

So if your paying off right away why even bother putting it on the card. I'm just extremely debt adverse, but to each his own if an individual feels they can manage it in a responsible manner go for it.

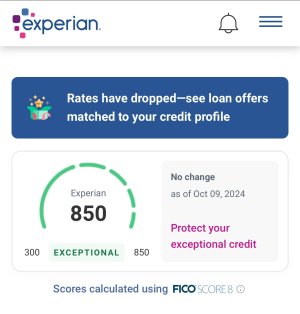

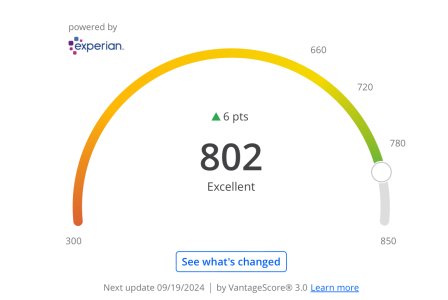

For cash back, points, boost credit etc there are many reasons. If it is paid in full by the end of the month it's not debt. You have a 0 balance.

I want to double my limit.

I want to double my limit.