- 3,949

- 1,197

- Joined

- Nov 16, 2001

Depends how you want to tackle it. Is '07 when you stopped paying? How much is it?Thanks man, Im in this process to. Was thinking of going with lex law, but im going to run through it myself and gain some knowledge and empowerment. I have a 600 credit score, and four negative things on my report i need to deal with. And you just gave me a foot hole to climb with.Even better is to go to annualcreditreport.com, which is the official record reported by the 3 credit bureaus. Choose all 3 and then go through and see what each one is reporting and take direct action from there.I gave you alternatives. Find out what is on your credit report, not what your score is.yeah okay, I have ck and my credit score now in the 300s man, trying to get up. That's why I suggested if y'all had alternatives other than paying the 100 bucks a month , that would be been like a plan c.

Go to Credit Reports on credit karma you will want to look at Public Records and Collections,those two areas will tell you what your negatives are.

That is step one, after you figure out what is one you report we can give you direction in what actions to take.

If there is an inaccuracy, go to each agency's dispute section on their website and dispute any inaccuracies.

https://dispute.transunion.com/dp/dispute/landingPage.jsp

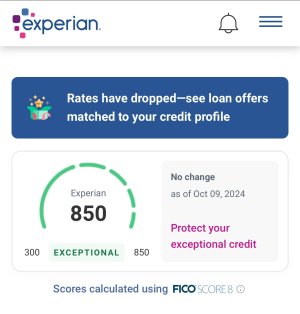

http://www.experian.com/disputes/main.html

https://www.ai.equifax.com/CreditInvestigation/home.action

If you have any records you don't think are yours, go to the reporting company and request they show proof the debt is yours and that they have 30 days to respond under the "Fair Debt Collections Practices Act". Make sure to send the letter "Return Receipt requested" to show proof they received it and that their countdown has started.

But one questions.. Do I ask them on phone to prove debt, or sending a letter is a must? I think two of the debts are from 07 so they already passed their limits, and one of the other ones doesnt even have a date on it.. so thats sketchy..

I would call AND send a letter. Call and ask them what proof they have it's yours and if they can mail/email it to you. Once you get proof, you can send them the money owed or a settlement. Before agreeing to any settlements make sure you have the money in hand since that's how you're going to negotiate from a position of power. Tell them if they're not willing to take it you have two other companies behind them that are willing to take it.

When talking to them, try to record the conversation so if they do anything sketchy/illegal you have it and can turn them over to the CFPB. If they can't prove it's yours, request to be taken off and send them a letter stating the same return receipt requested. Otherwise, you'll report and sue them for violating the FDCPA.

Lastly, once you agree to giving them any money, DO NOT give them your bank account or card number. Make sure you give them a cashiers check or money order. NO personal checks since that has your account info on it. If you want to do a card, get a prepaid debit card so they can't just wipe you.

still mad about the disagreement of maxing out a card every month, it's not that serious.

still mad about the disagreement of maxing out a card every month, it's not that serious.