- 94,065

- 33,108

- Joined

- Oct 24, 2010

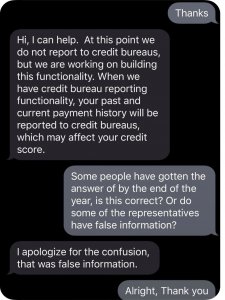

Discover is offering 0% APR on new purchases for 12 months for current members.

Chat with them on the app, and ask if there are any promo deals for current members. They will transfer you to an APR specialist, who will offer you the deal.

Link?

Pretty much maxed out with that card now, don't need them asking for all that extra infor for another CLI haha. Now to get my amex from 16.7 to the 20k range. Meanwhile my chase freedom is sitll at a $500 limit

Pretty much maxed out with that card now, don't need them asking for all that extra infor for another CLI haha. Now to get my amex from 16.7 to the 20k range. Meanwhile my chase freedom is sitll at a $500 limit