- 2,559

- 1,612

- Joined

- Aug 16, 2004

Looking for advice - my credit was absolutely shot a decade ago and one of the first cards I got was this crappy Credit One Card with a high APR and nickel-and-dime fees. Grew the card organically from $300 limit to $3200. It’s a really bad card that I’m paying $108 a annual fee but it’s my second longest card on my file (secured card is the only longer one by a year).

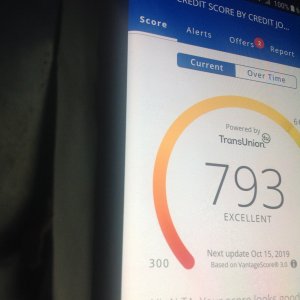

Score is at my personal high of 813 and waiting to confirm each bureau is reporting that card fully paid off before I go and ask AMEX to bump my limits on my Blue Cash and Everyday cards.

Interested in possibly getting the Amex Gold but I don’t know if I can responsibly hit the $6K spend to qualify for the bonuses. Leaning toward just staying with what I have and closing the Credit One. However, we may be buying a house next year and I don’t know how drastically closing that card would affect my score/profile.

TL;DR for someone with a light file but good score should I just eat the fee on the junk card to keep the history on my file?

Score is at my personal high of 813 and waiting to confirm each bureau is reporting that card fully paid off before I go and ask AMEX to bump my limits on my Blue Cash and Everyday cards.

Interested in possibly getting the Amex Gold but I don’t know if I can responsibly hit the $6K spend to qualify for the bonuses. Leaning toward just staying with what I have and closing the Credit One. However, we may be buying a house next year and I don’t know how drastically closing that card would affect my score/profile.

TL;DR for someone with a light file but good score should I just eat the fee on the junk card to keep the history on my file?

too much churning the last few years

too much churning the last few years