- Jul 12, 2005

- 522

- 381

Never lurked in this thread prior to today. Wish I had, a lot of great comments and suggestions.

Closed on a new development condo three months ago. Was very happy with the deal I got. I signed the contract back in June when a lot of developers were panicking. Brooklyn has done quite well during the pandemic where everyone from Manhattan seems to be moving here.

I put an offer in at the right time. Developer paid for ALL my closing costs and accepted my reduced price offer. There's no way I'd get the same offer accepted right now.

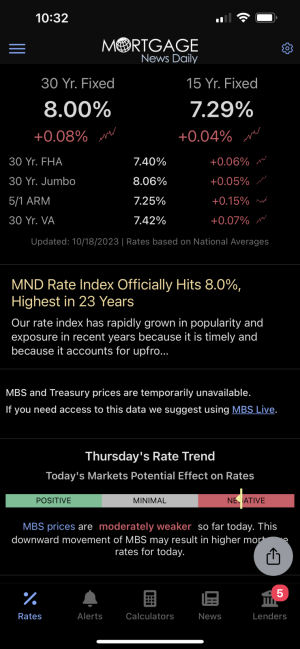

If anyone in the NYC area has any questions about the process, from mortgage inquiries to the closing costs and all the obstacles in between, let me know. Happy to help with any questions here.

Closed on a new development condo three months ago. Was very happy with the deal I got. I signed the contract back in June when a lot of developers were panicking. Brooklyn has done quite well during the pandemic where everyone from Manhattan seems to be moving here.

I put an offer in at the right time. Developer paid for ALL my closing costs and accepted my reduced price offer. There's no way I'd get the same offer accepted right now.

If anyone in the NYC area has any questions about the process, from mortgage inquiries to the closing costs and all the obstacles in between, let me know. Happy to help with any questions here.