When I graduated at 24, I had a Durango that was paid off...got my first job as a professional and went Durango to G35 to 335i to custom order 135i lease. I bought myself a Tag when I graduated, then added an Omega, then a Breitling. All that in a matter of like 3 years. My wakeup call was when my employer made everyone re-interview for their jobs. I didn't lose mine, but it made me realize, that no matter how safe you feel and no matter how much your employer pays you, a life-changing, financially-devastating event is potentially just one day away.

I wanted to get out of my lease, be smart and downgrade...but there were monetary penalties. So, I rode it out. I saved money every pay check during that lease, knowing that I would have to buy something afterward and didn't want a car payment. I also began to budget, tracking my spending across various catergories. In a span of 3 years, I saved 10-months expenses for emergencies, paid off 50k in student loans, and paid for my next car with cash. (An unintended bonus was, I met my gf during that period...now we live together which allows me to cut near all my expenses in half).

What I've learned is, it sucks to work all the time and not get the finer things (I drive a Mazda3 now), but that pales in comparison to the joy of having financial cushion and not stressing about money. Where I'm at right now, I've been able to trim my work week to 4 days, my car is paid off, my expenses are low, and I'm able to save money every paycheck after I allot myself a couple hundred bucks of fun money to do whatever. Peace of mind trumps baller status all day for me.

You can definitely do it. You just have to be committed, and hopefully your significant other is down for the cause too...If not it'll be as if you are trying to move forward while someone is pulling back against you. Either way, I feel you are already on the right track by admitting your past mistakes. (If you're not upside down on those cars, perhaps trade them in and then get two used cars with some years on 'em).

Solid advice, Still Itachi.

I appreciate the feedback.

I graduated at 23 as well, and was driving a pristine 2003 Maxima that I should have held on to - it was like 6 months from being paid off. Like you, I got the itch for a new car.

Long story short, one bad purchase put me in the red almost immediately and I'm upside down. I didn't do my homework, and got sucked into BMW's Select Financing. Ended up trading in the car and rolled the negative equity into a lease in order to be able to walk away faster. Sounds dumb, but I got a hook up from a friend who is a GM at a Lexus dealership and Ill be able to walk away in another 1.5 years and not have a $700 car payment and nothing owed.

As others have suggested, selling the car would normally be the right move, but I have to ride out this lease and continue to make the payments.

The good news is, I don't have any credit card debt except the 20-30% I use every month, and my student loans are only $5k. We are currently renting, so are not tied down to mortgage either. Our son will start grade school in the Fall, so that will save us $500 month.

I feel you on the whole idea that circumstances can literally change in a matter of a day. I was laid off a couple years ago, but luckily found another job within 3 weeks that actually paid better, but it still shook me up. Luckily at the time I was not paying rent and my expenses were fairly low.

With all that said, you would think I would learned my lesson and saved for a rainy day

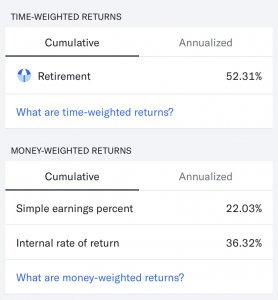

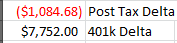

I definitely have expenses I could cut back on - cell phone is $160 month and Cable/Internet is about the same. I am really tied down with the car payments right now, but at least I am learning along the way. I am saving for retirement and have a legal side hustle that has been good to me for almost 8 years now, so the extra cash flow I guess is why I have stayed in this holding pattern because I typically make $300-400 cash each weekend.

I still know I could save more if I tried - just have to stop buying random stuff that I don't need.