da r entertainment

Supporter

- 9,761

- 3,572

- Joined

- Jul 20, 2002

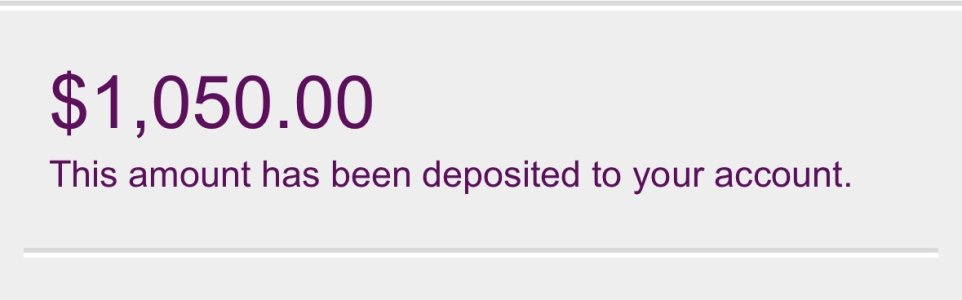

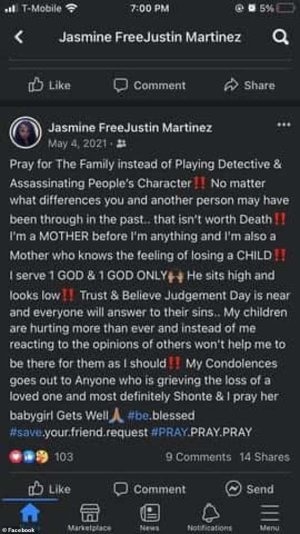

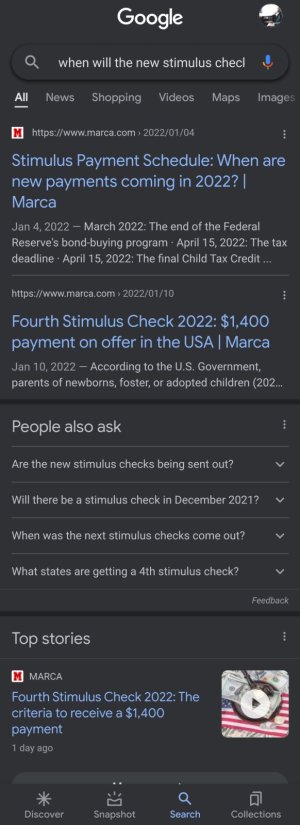

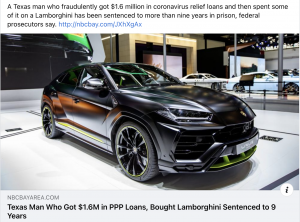

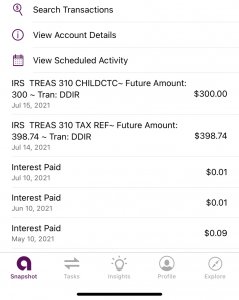

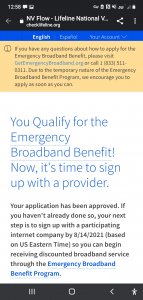

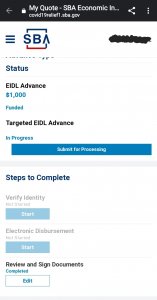

This **** almost feels deliberately planned to bait and hook people that have a tendency to try to get over on them...crazy.

This is where accountability comes in to play. Folks made a choice and gotta die on that bridge.

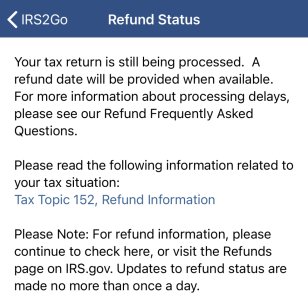

As far as taxes prohibiting the purchase of a home, definitely wouldn't recommend letting it get that far as that means they have a judgement on you. IRS is pretty cool about payment plans as I have a friend on one now with them.