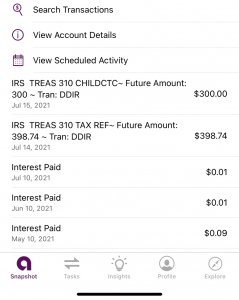

- 13,924

- 5,900

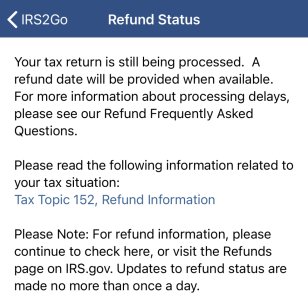

Yeah it should be accounted for in the software (if it’s in the actual bill that got signed). I know there was talks about it last week into Monday. Haven’t really heard anything official. The $10,200 was a tax break on just unemployment income. If you earned $12,000, only $1,800 would be taxable, and your other gig work related stuff will as a result be taxed lower as well. Unemployed are basically getting a $10,200 agi drop (if it passed). That’s been my impression of it.I haven’t filed yet for this year because like 30% of my income was non taxed (gig job - not unemployment)

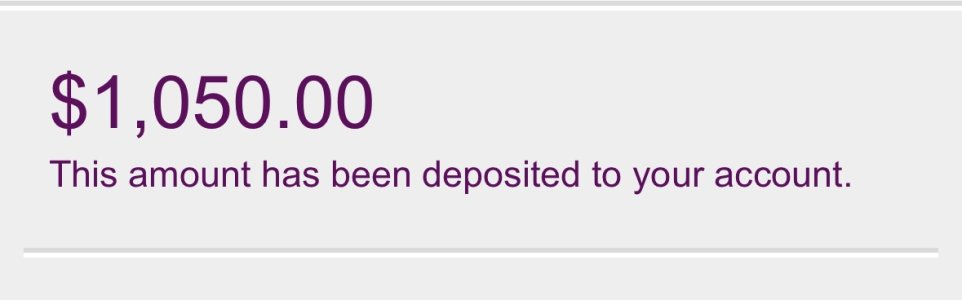

Hmm maybe this new tax forgiveness will cancel that out and I’ll get my normal return amount

How would I go about doing it? My dad does my taxes with the H&R Block software, maybe it’ll be an option on there or something ?