In my state they call it a working family tax credit (which is 10% of what the federal earned income credit is). To qualify for one, you need the other or vice versa. So there was some confusion on how to claim the working family credit on state taxes. But it’s pretty much automatic. If it shows zero for WFTC, it means you were above the EITC threshold. There was no extra work involved. You don’t have to claim anything, it’s just worked into their figures.

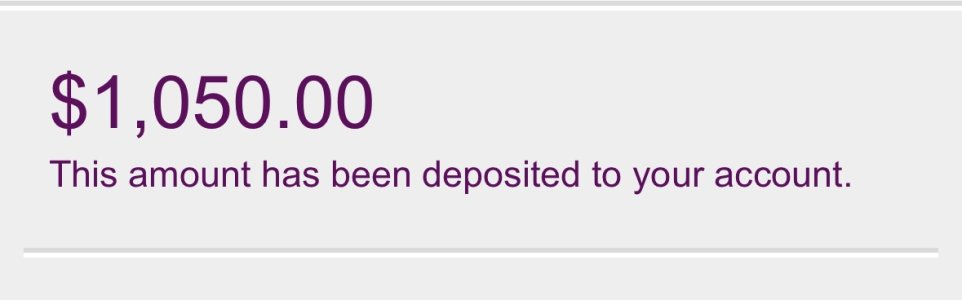

it just sucks for those at the limits. If you earned $15,600, you got zero EITC, and thus no WFTC, and no $600 state stimulus. But $15,599, you get a dollar or so in EITC, and like 10 cents in WFTC, and you qualify for the $600.

It’s definitely time to hustle correctly. Some poor PT worker grinder a bit too much and lost out. The same applies for that retirement tax credit. If you are a dollar above, it goes from 50% tax credit to 20%. That’s as much as a $300 loss by earning a dollar more.