- 63,610

- 50,738

- Joined

- May 23, 2005

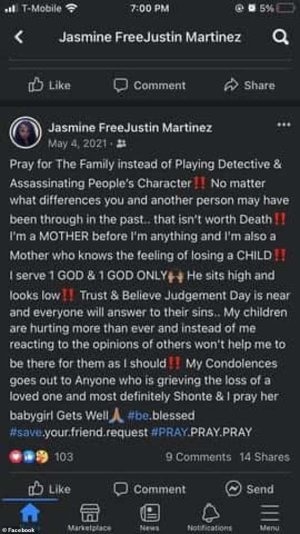

MY CALIFORNIA PEEPS WITH KIDS

EVEN IF U DONT GET FOOD STAMPS

THEY WILL GIVE U EBT FOR UR KIDS

$365 PER ELIGIBLE CHILD

SINCE WE GOING THROUGH THIS CRISIS

APPLY HERE

HERES SOME FAQS SO I DONT HAVE TO ANSWER THEM ALL

What are ‘P-EBT’ or Pandemic EBT benefits?

Due to coronavirus (COVID 19), children who are eligible for free or reduced-price meals at school will get extra food benefits. These food benefits are called Pandemic EBT or P-EBT benefits. P-EBT benefits help families in California buy food when school is closed.

Who is eligible for P-EBT benefits?

Children are eligible for P-EBT benefits if:

How do I get P-EBT benefits?

Most families with children who receive CalFresh, Medi-Cal or Foster Care benefits do not need to apply online. They will get their P-EBT card in the mail during the month of May. P-EBT cards will begin arriving around May 11, 2020 through May 22, 2020.

Families with children who applied for CalFresh, Medi-Cal or Foster Care benefits after their school closed will get their P-EBT card in the mail before June 30, 2020.

Families with children who are eligible for free or reduced-price meals and who do NOT get CalFresh, Medi-Cal or Foster Care benefits must apply online before June 30, 2020.

If I already got a P-EBT card in the mail do I need to apply online?

No. If you already got a P-EBT card in the mail do not apply online. Follow the instructions that came with your P-EBT card and create your private PIN number. Then your card will be ready to use.

Is my family still eligible to participate in school meal programs at COVID-19 emergency locations if we receive P-EBT?

Yes. P-EBT benefits are additional benefits that do not replace any child nutrition program meals being offered. Children may continue to receive "grab n go" meals or emergency food at COVID-19 emergency feeding sites offered by schools and community locations, even if they are receiving P-EBT benefits.

How much in P-EBT benefits will I get?

You can get up to $365 for each child who is eligible for P-EBT benefits. The total amount you will get depends on how many eligible children are living in your home.

Most families with children who are eligible for free or reduced-price school meals will get $365 for each child. If you do not get your P-EBT card in the mail and you apply before June 30th, 2020, you will get the full amount of benefits.

Families with children who applied and got CalFresh, Medi-Cal or Foster Care benefits after their school closed, may get less than $365 for each child. This depends on when you applied for CalFresh, Medi-Cal or Foster Care.

What can I buy with P-EBT benefits?

Your P-EBT benefits can buy food at most grocery stores and farmer's markets, and to purchase groceries online at Amazon and Walmart.

Use your P-EBT card like a debit card:

What should I do when I get my P-EBT card in the mail?

Follow the instructions that came with your P-EBT card and create your private PIN number. Then your card can be used to buy food in most grocery stores and farmer's markets.

When is the deadline to apply for P-EBT benefits?

If you do not get a P-EBT card in the mail, you must apply online by June 30, 2020 to get P-EBT benefits. P-EBT benefits are only available while schools are closed due to coronavirus (COVID 19). If you did not get a P-EBT card in the mail and do not apply by June 30, 2020 you will not be able to get P-EBT benefits.

What if I applied online and haven't received my P-EBT card?

Call California's EBT customer service center at (877) 328-9677. You can reach them 24 hours a day, 7 days a week.

How long do I have to spend my P-EBT benefits?

You can use your P-EBT benefits for one year. It starts on the date you get your P-EBT card.

If I get P-EBT benefits, will it make me a public charge?

P-EBT is a disaster emergency benefit based on free and reduced fee school meals eligibility, similar to other benefits that DHS has said would not be considered for public charge purposes. However, USCIS can consider several factors under their public charge test.

Public charge does not apply to all immigrants. If you have questions about your immigration status and this food benefit, more information is available here, including a list of free and low-cost immigration services providers.

What if I'm supposed to get a P-EBT card sent without applying, but had a recent change in address?

If you have not received a P-EBT card by May 25 AND you currently receive CalFresh, CalWORKs, Medi-Cal, or Foster Care benefits we may not have your most recent address. Do NOT apply online to report a change of address. Instead, you can call the EBT Customer Service Center (877-328-9677) to request a change of address beginning the week of May 25. After confirming eligibility, a new card can be issued to your new address.

EVEN IF U DONT GET FOOD STAMPS

THEY WILL GIVE U EBT FOR UR KIDS

$365 PER ELIGIBLE CHILD

SINCE WE GOING THROUGH THIS CRISIS

APPLY HERE

HERES SOME FAQS SO I DONT HAVE TO ANSWER THEM ALL

What are ‘P-EBT’ or Pandemic EBT benefits?

Due to coronavirus (COVID 19), children who are eligible for free or reduced-price meals at school will get extra food benefits. These food benefits are called Pandemic EBT or P-EBT benefits. P-EBT benefits help families in California buy food when school is closed.

Who is eligible for P-EBT benefits?

Children are eligible for P-EBT benefits if:

- Their school is closed due to coronavirus (COVID 19); and

- They are eligible for free or reduced-price school meals

How do I get P-EBT benefits?

Most families with children who receive CalFresh, Medi-Cal or Foster Care benefits do not need to apply online. They will get their P-EBT card in the mail during the month of May. P-EBT cards will begin arriving around May 11, 2020 through May 22, 2020.

Families with children who applied for CalFresh, Medi-Cal or Foster Care benefits after their school closed will get their P-EBT card in the mail before June 30, 2020.

Families with children who are eligible for free or reduced-price meals and who do NOT get CalFresh, Medi-Cal or Foster Care benefits must apply online before June 30, 2020.

If I already got a P-EBT card in the mail do I need to apply online?

No. If you already got a P-EBT card in the mail do not apply online. Follow the instructions that came with your P-EBT card and create your private PIN number. Then your card will be ready to use.

Is my family still eligible to participate in school meal programs at COVID-19 emergency locations if we receive P-EBT?

Yes. P-EBT benefits are additional benefits that do not replace any child nutrition program meals being offered. Children may continue to receive "grab n go" meals or emergency food at COVID-19 emergency feeding sites offered by schools and community locations, even if they are receiving P-EBT benefits.

How much in P-EBT benefits will I get?

You can get up to $365 for each child who is eligible for P-EBT benefits. The total amount you will get depends on how many eligible children are living in your home.

Most families with children who are eligible for free or reduced-price school meals will get $365 for each child. If you do not get your P-EBT card in the mail and you apply before June 30th, 2020, you will get the full amount of benefits.

Families with children who applied and got CalFresh, Medi-Cal or Foster Care benefits after their school closed, may get less than $365 for each child. This depends on when you applied for CalFresh, Medi-Cal or Foster Care.

What can I buy with P-EBT benefits?

Your P-EBT benefits can buy food at most grocery stores and farmer's markets, and to purchase groceries online at Amazon and Walmart.

Use your P-EBT card like a debit card:

- Select "EBT"

- Swipe the card

- Enter your private PIN number

What should I do when I get my P-EBT card in the mail?

Follow the instructions that came with your P-EBT card and create your private PIN number. Then your card can be used to buy food in most grocery stores and farmer's markets.

When is the deadline to apply for P-EBT benefits?

If you do not get a P-EBT card in the mail, you must apply online by June 30, 2020 to get P-EBT benefits. P-EBT benefits are only available while schools are closed due to coronavirus (COVID 19). If you did not get a P-EBT card in the mail and do not apply by June 30, 2020 you will not be able to get P-EBT benefits.

What if I applied online and haven't received my P-EBT card?

Call California's EBT customer service center at (877) 328-9677. You can reach them 24 hours a day, 7 days a week.

How long do I have to spend my P-EBT benefits?

You can use your P-EBT benefits for one year. It starts on the date you get your P-EBT card.

If I get P-EBT benefits, will it make me a public charge?

P-EBT is a disaster emergency benefit based on free and reduced fee school meals eligibility, similar to other benefits that DHS has said would not be considered for public charge purposes. However, USCIS can consider several factors under their public charge test.

Public charge does not apply to all immigrants. If you have questions about your immigration status and this food benefit, more information is available here, including a list of free and low-cost immigration services providers.

What if I'm supposed to get a P-EBT card sent without applying, but had a recent change in address?

If you have not received a P-EBT card by May 25 AND you currently receive CalFresh, CalWORKs, Medi-Cal, or Foster Care benefits we may not have your most recent address. Do NOT apply online to report a change of address. Instead, you can call the EBT Customer Service Center (877-328-9677) to request a change of address beginning the week of May 25. After confirming eligibility, a new card can be issued to your new address.