From litecoin Telegram

“Why all this crap happens...........

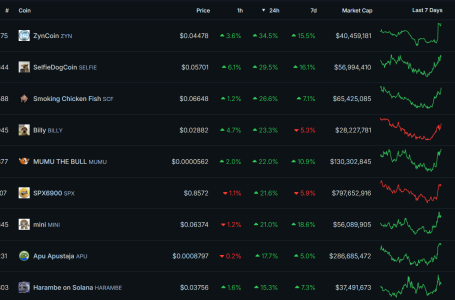

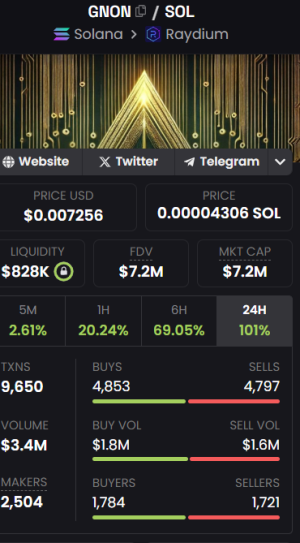

Cryptocurrency markets are unregulated. They are global. And they never sleep. This means they are rife with manipulation.

People often talk about “whales” manipulating the market, usually at the expense of “weak hands” or “normies”.

Here’s how it happens.

A whale is a person with a huge amount of money at their disposal. They have enough money to move the market.

Because many cryptos start out so cheap and become so expensive, early investors can become whales fairly easily. They are usually early investors, or just people with an awful lot of money.

If they want the market to tank, they make a number or big sell-orders below the current market piece. This can make the market drop very fast.

This then triggers people’s automatic sell orders and sends the market crashing even further.

Then ordinary investors see the market is tanking and the FUD cycle gets going.

To make things worse, the whales usually time their big sell-offs to coincide with bad news, or rumours. For example, all the China FUD in September.

The “normies” and “weak hands” are the people particularly prone to selling in these crashes.

Weak hands tend to have put in money they cannot afford to lose, and so can’t risk waiting out the crash. They are forced to sell.

Normies are people who heard the market it flying and want in. They haven’t done much research and don’t understand the bigger picture behind the crypto revolution.

Normies believe the mainstream press on bitcoin and are sure all this crypto nonsense is a bubble looking for a pin. But they also don’t want to miss out on the huge gains on offer. So when their suspicions are proved right and the market dips, they think it’s the end and they sell.

This is why many of the crypto community talk badly about “weak hands” and “normies”. If it wasn’t for them, there would be fewer crashes and the crashes wouldn’t be as deep.

However, normies and weak hands are also the very same people FOMOing back in when the whales put in some big buy orders and send the market rebounding.

They are the fuel that powers the FOMO vs FUD cycle. And they are the ones bringing the majority of money into the market.

So although they get a lot of flak, they are the ones sustaining the market. They are the ones selling low and buying high. They are the proverbial impatient handing their money over to the patient.

As blockchain technology matures, it will create value for itself with world-changing applications and businesses. It will be less based on rumour and speculation and more on actual working businesses. That time is coming, fast.

But for now, it’s the speculators driving the market. So you can expect the FOMO and FUD cycles to continue.”

Very well put, btw I suggest if any of ya haven’t, to follow the telegrams for coins you are interested in, also if they run dischords...you can find some good hidden info in there