- 29,701

- 39,453

- Joined

- May 25, 2004

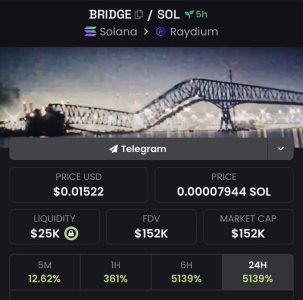

It’s all so new we’re gonna see a lot of coins fail and some will rise to the top. Then there will be plenty where you can get in and make money but better not hold them.

I like Sol. It’s like eth but actually finished.

I like Sol. It’s like eth but actually finished.

.

.