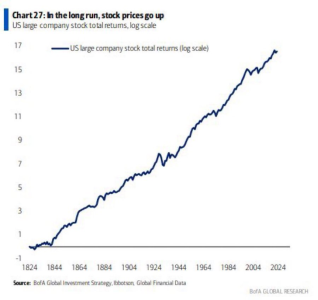

I’ve been sharing here off and on for awhile now. I have a do nothing 401k that I use for the 10% tax benefits. At its worst at this very moment, ytd I am down 9% (it was 12% two days ago).

It’s a nearly equal split between a sp500/sp400/russell 1000/us reit index funds. What’s funny is for a two year window, I’m up 50% still. That 2018 and again in 2020 drop were vicious. This is nothing folks.

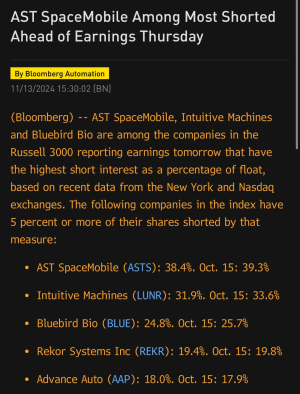

In the same vain, many stocks are way down from just 1-2 years back. But still up from 5 years ago. How many are truly long in some of these stocks?