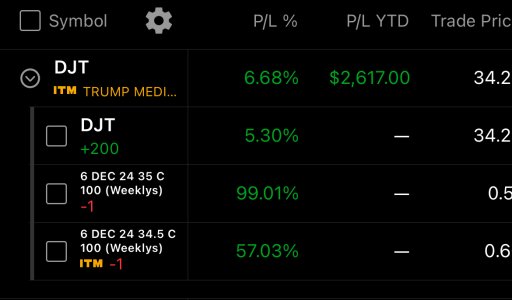

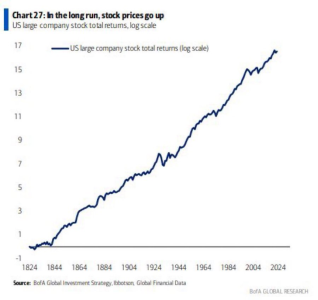

The market looks like it will take one of two paths from here: on the one hand, a “bad-is-good” market reaction (rate cuts) could continue to support the recent rebound in stocks as it digests today’s below expected GDP data…however, if growth is truly falling apart, there’s risk of a more substantial pullback. If we see more negative economic data, don’t be surprised if you start hearing about the “hard landing” narrative again.

On the other hand, solid growth data w/stable yields and strong earnings could lay the groundwork for a surge toward ATH in the 500 as we get closer to the election - the outcome we want - wide range of asset classes that historically outperform in inflation spike environments (as I’ve stated numerous times in here) is the play.

Please trade with your brain and not your heart, NT.