- 4,300

- 4,369

- Joined

- Jul 20, 2012

LB

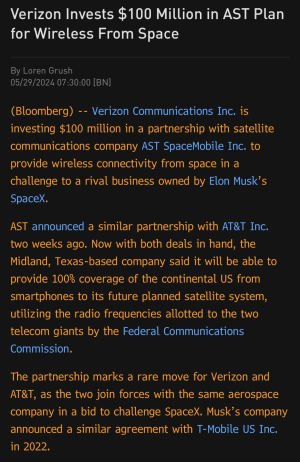

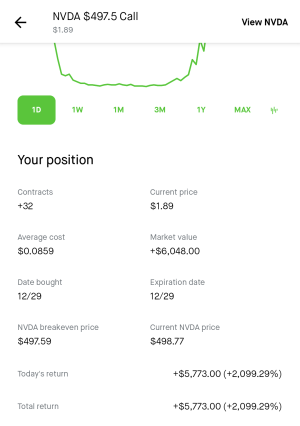

Definitely had the bears in the market come out these past two days Thursday being the worst day

At least for me due to one of the big wigs stepping down I guess

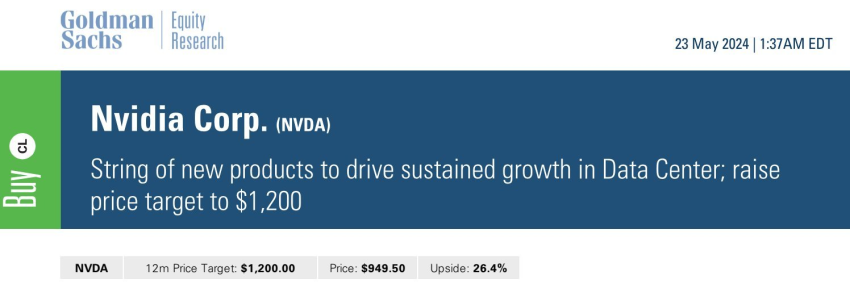

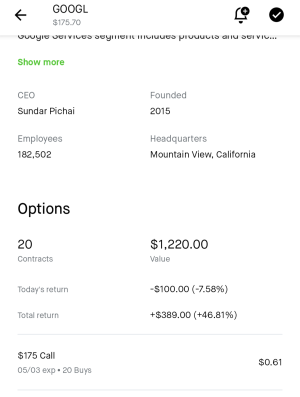

I got a play in motion for Monday

But I got to remember that pre market (for my strategy at least) is the best time to sell

Don’t let FAMO get you take my W’s and research for the next play

I seen some stocks be up 10% pre market and then plummet when the bell rings and don’t recover period it’s rare that I seen it keep the same energy during regular hours same thing goes for post but the good thing about post is if it goes up because the earnings report it can continue the next morning even with some people selling yesterday

Definitely had the bears in the market come out these past two days Thursday being the worst day

At least for me due to one of the big wigs stepping down I guess

I got a play in motion for Monday

But I got to remember that pre market (for my strategy at least) is the best time to sell

Don’t let FAMO get you take my W’s and research for the next play

I seen some stocks be up 10% pre market and then plummet when the bell rings and don’t recover period it’s rare that I seen it keep the same energy during regular hours same thing goes for post but the good thing about post is if it goes up because the earnings report it can continue the next morning even with some people selling yesterday