- 74,663

- 24,062

- Joined

- Apr 4, 2008

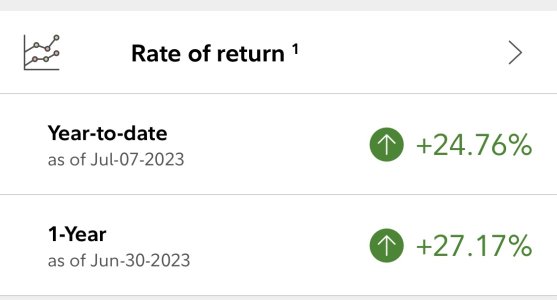

Yep in all honesty, if you don't get a headstart in the meantime, find your niche, fool around, learn from mistakes etc. before real cash is involved, you'll either lose some dough or grossly underperform your potential. Just get on the simulator and have some fun developing a strategy that works for you. Study and practice and when the time is right, you'll be more prepared.

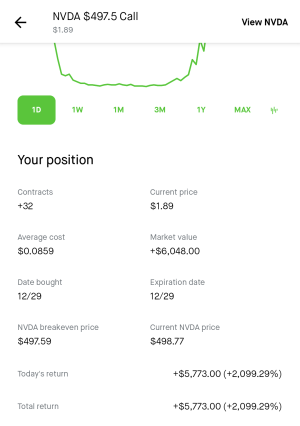

i've learned so much as a result of blowing up last year.

i've learned so much as a result of blowing up last year.