- 2,263

- 828

- Joined

- Apr 1, 2015

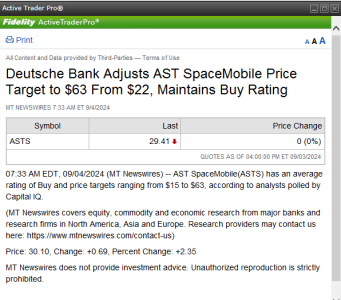

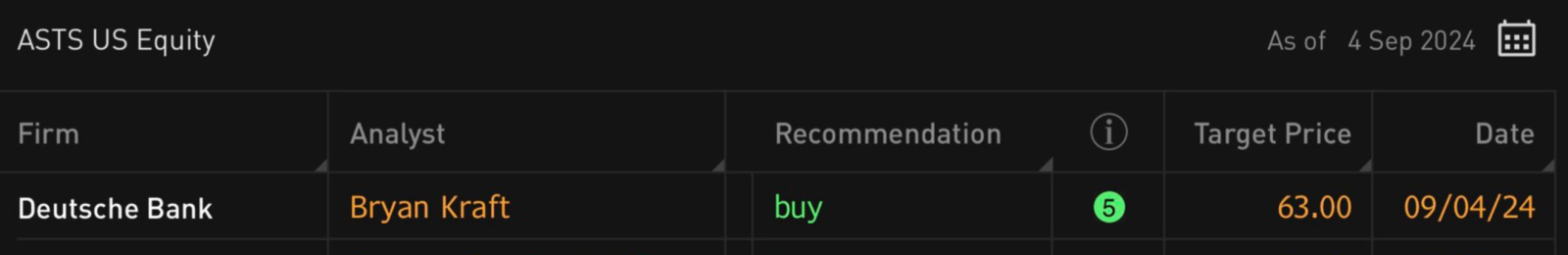

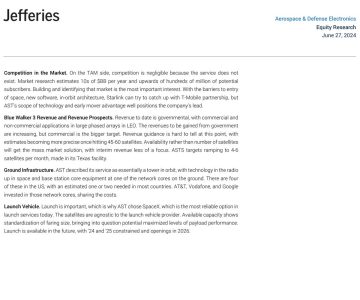

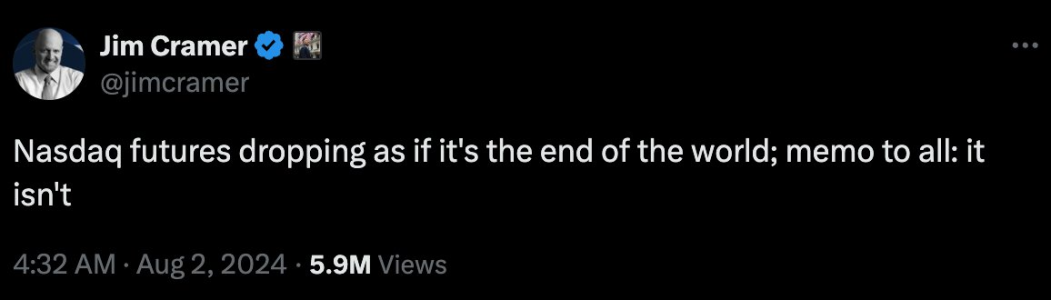

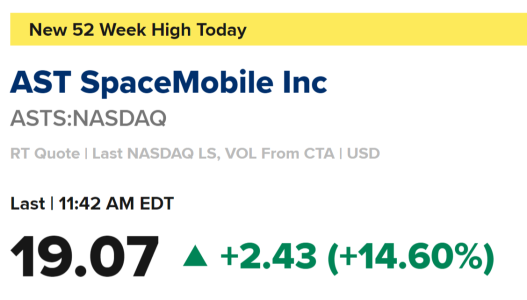

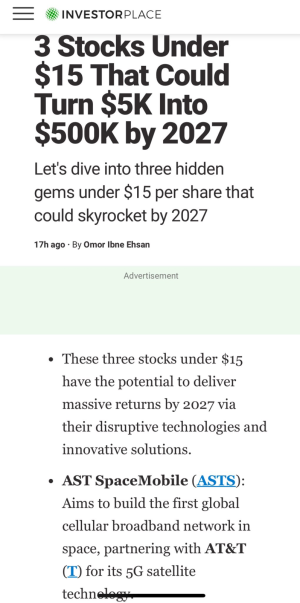

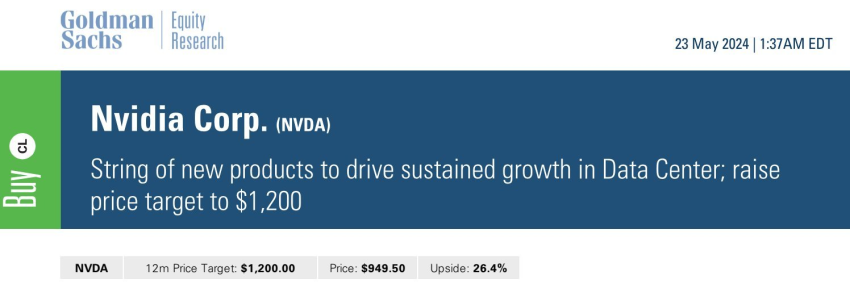

Never opened an IRA of any kind but I'll into it. Was planning to get into the stock game but need to do way more research.you should take it low as you can....better to use the funds you wanted to invest in 401k this year into a roth or reg IRA and attempt to double it when this hits floor

folks you have time to put 6k from 2019 and 6k for 2020 into a roth ira......buy few stocks that doubles in 12-16 months.....