- 4,573

- 5,316

- Joined

- Jul 29, 2012

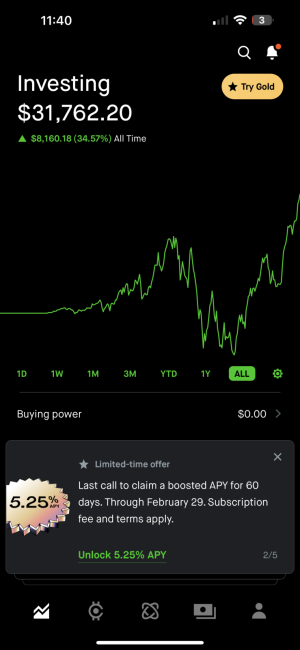

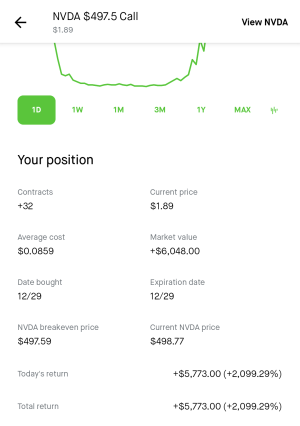

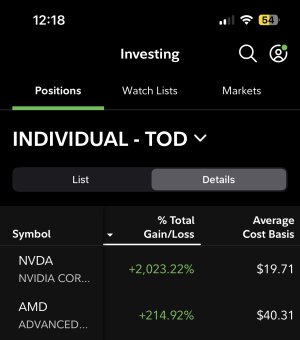

Are there short term gains taxes involved when day trading? If yes, at tax time do you get something from the brokerage acct that you can take to your tax person or do you have to keep track?

Can cancel out gains with losses (just keep in mind)