- 6,830

- 5,112

- Joined

- Mar 13, 2014

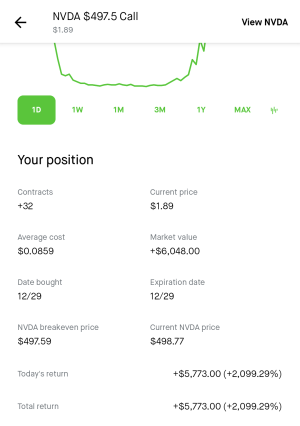

Decided to let go of my Twitter call option for a $9 profit. Wasn't looking for a huge gain since this was my first time and I only had one day to let go of them.

On another note, it looks like Tilray is crashing hard. Hope nobody decided to get in after this huge gain. That would have been crazy. I personally would love for it to go back below $50.

On another note, it looks like Tilray is crashing hard. Hope nobody decided to get in after this huge gain. That would have been crazy. I personally would love for it to go back below $50.

if they ever figure out how to monetize $50 easily.

if they ever figure out how to monetize $50 easily.