- 74,463

- 23,929

- Joined

- Apr 4, 2008

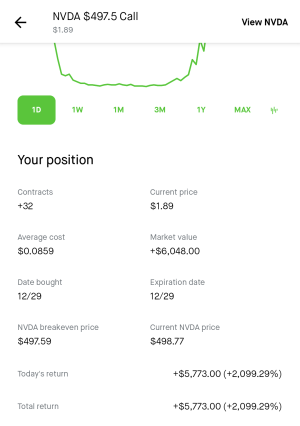

You’ve got the right idea but when it comes to taking targets and setting orders it’s most effective to use supply and demand zones to set your orders. My advice is figure out what indicator and system speaks to you and read as much as possible about charting and candlesticks.How do you guys develop a plan?

Set your buy limits and figure out what you are comfortable with, and set up stops (lock gains or stop losses) with what you are happy with? I know many do lots of technical analysis, hope to learn that over the summer.

Finally jumped on ROKU Monday (or I think Friday). Thank gooooodnesss. Set a buy a limit and just let it run. Been eyeing this for like 6 months. Bought a few, hope to add more to have a decent amount of shares.

I think I'm gonna grab a few DIS again. Got burned in March cause I was in a panic mode. But now I'll hold out until the sun burns out.

Anyone play Canadian stocks?

Looking for more options.

The US stocks are much more interesting/fun though lol

Good thread here

Last edited: