It's not even the stocks, it's the timing that's been miserable. I need to just clear my head and do what's made me successful these past couple of months.

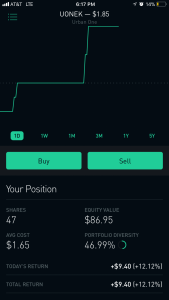

Not protecting those quick profits with the QURE IPO messed me up, and then I went in too high/quickly on EGLT yesterday. I like the IPO game, but I've been jumping in too quickly instead of letting the stock find its footing. Those two botches are what's weighing me down.

This morning I got shaken out on a couple of plays because I chased instead of letting the stocks set up.

The biggest sin is probably me having stocks I like at levels (AAPL sub 500, DDD in the 50s) that I didn't buy like I said I would.

Just gotta chip away and I'll be in the green in due time.

Played EGLT instead of the other 2 IPOs, sold out at 12 for a 30 cent a share loss. Didn't like the action.

Played EGLT instead of the other 2 IPOs, sold out at 12 for a 30 cent a share loss. Didn't like the action.