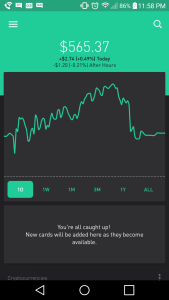

I am looking to learn. I have 2k and I want to learn about the market and eventually get into trading/investing as a full time thing. Always been amazed by numbers and finance so I want a career change.

I'd say get Nate's DVD before you start: InvestorsLive Textbook Trading DVD. It's a streaming dvd and it's pricey, but if you want to be a serious day trader, it might save you money in the long run. Had I watched the DVD in February, I wouldn't have blew up my account. That's the other thing. Be smart and patient. Keep saving your money and keep studying. Trading is all about risk management. It's not your wins that make you, but your losses. You need to have a plan and a reason to trade. You need to know where to place your stop and you need to respect it. You shouldn't be adding to a loser ever unless that was your plan from the get-go (take a starter and average in).

Read these 7 rules:

http://bullsonwallstreet.com/7-trad...al&utm_source=twitter.com&utm_campaign=buffer

Bulls are pretty decent educators as well. They have a bootcamp coming up and they're usually willing to work with you if you need a payment plan for the fee.

90% of traders fail. It's a game designed to chop you out and leave you broke and desperate. But it doesn't have to be that way. You can be in the 10% that trade well consistently. You just need to study, learn how to create a plan and follow it. Never break your rules. They're there to protect you and keep you in the game. Losses happen, it's your job to keep them small so when you have winning trades, the losses don't absorb the majority of those gains.

This book is pricey, but it helps, especially if you're a new trader.

Amazon product ASIN 1598795805

Learn your time frame. Do you want to day trade, swing trade, or invest? Learn technical analysis and if your time frame is on the longer end of the spectrum, learn fundies. I don't really deal with fundamental analysis because I don't buy and hold stocks. I'll swing trade some options, but more often than not, I wanna be cash for the most part at the end of my day. It's easier for me to sleep at night that way.

Don't play earnings reports or catalysts naked. And by naked, I mean with common stock.

Instead, if you want to play these events, you'll be better off doing so with basic call/put spreads and butterflies so you won't be prone to drops in volatility or if you're wrong, it won't cost you too much. This is a little more advanced, but it's worth knowing. I got my *** kicked bag holding FSLR from the end of December till Idk ******* March when they had their earnings report. Week of the report, my shares went from being underwater to in the green, but instead of using this chance to bail out, I rolled the dice and took that common into the report. The stock shot down 10 bucks in a matter of minutes and the following morning I closed my position for a $4,000 loss. A month later at analyst day the stock ripped 20 bucks and I had to watch it like a **** instead of cheerleading. It was a bad job all around because I bag held, I didn't use a stop, I didn't have a plan and I added to a loser.

The market is all about psychology. And you yourself need to be zen in order to excel. You need to be clear headed, you need to trust your intuition and your plan, and you need to stay level. You can't have highs and lows. Don't get emotional, be stoic. The only time you should be afraid is when you take a trade without a plan. If you know your stop, if you know how to read a chart, you'll have no reason to be afraid.

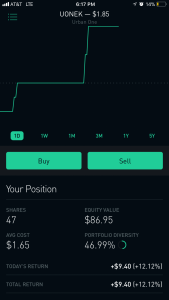

no position but really nice move today. Was a ton of UOA on Friday, calls and puts. Like they knew the announcement would be made.

no position but really nice move today. Was a ton of UOA on Friday, calls and puts. Like they knew the announcement would be made.  no position but really nice move today. Was a ton of UOA on Friday, calls and puts. Like they knew the announcement would be made.

no position but really nice move today. Was a ton of UOA on Friday, calls and puts. Like they knew the announcement would be made.  those 47.56 prints. thought about taking a put fly in this one for next week, 51-49-47, kinda glad i didn't since i think this flies through that range (higher or lower) before the 26th.

those 47.56 prints. thought about taking a put fly in this one for next week, 51-49-47, kinda glad i didn't since i think this flies through that range (higher or lower) before the 26th.