- 2,828

- 586

- Joined

- Apr 18, 2004

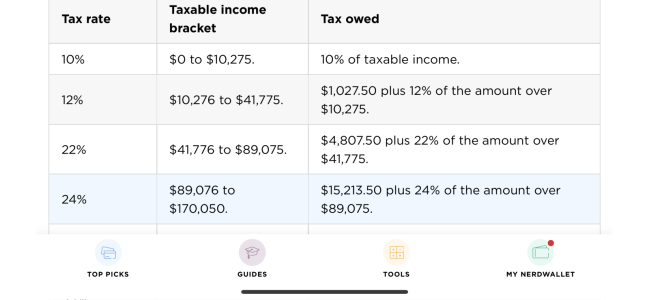

I really feel they totally messed up the new W-4 seems very trash to me. I would try to still file with the 2019 W-4, I will have to do more research on the new W-4 since it just came out but if you kept the same allowances than the tables didn't change that much. Most of my clients are seeing pennies differences in their paychecks vs the 2019 W-4.nydunkhead You got any Thoughts on the new withholding allowances calculations for 2020? It feels like the government is finally cracking down on excessive 'refunds'.

To answer your question I really believe the government loves big refunds (except returns that utilize the EIC and other refundable credits) because that means you gave them an interest free loan for the whole year and they made interest off your money instead of you.

my taxes are super simple which is why I continue to use their free service.

my taxes are super simple which is why I continue to use their free service.