- 13,917

- 5,869

- Joined

- Sep 28, 2004

For those asking about w4s. I use this

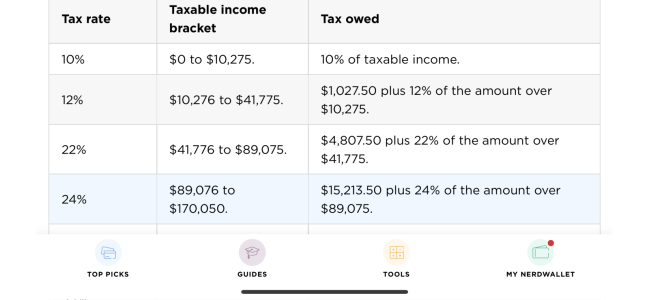

It’s a withholding chart that shows you your expected amount withheld under the 3 new scenarios (single/married/HoH)

One does sort of need to predict what you will be making for the entire year. But it’s pretty simple.

I also use an app called taxcaster. For 95% of americans, it's a 2-3 step process.

You have your set yearly income. Subtract deductions and that becomes your taxable income. That gets taxed at different marginal rates. That becomes your federal tax owed amount. One could then divide that by 52, or 26 (or whatever your pay period is) to get an idea of what needs to be withheld.

Mister Meaner

I think your tax girl is either lying to you, or going way beyond the credits and deductions with lies. There isn’t many tricks or ploys available. A single person making $100,000 for the year will have a tax liability of $15,253. There is little getting beyond that. Now unless youwithheld $20k, you'd honestly just be getting your money back.

Mister Meaner

I think your tax girl is either lying to you, or going way beyond the credits and deductions with lies. There isn’t many tricks or ploys available. A single person making $100,000 for the year will have a tax liability of $15,253. There is little getting beyond that. Now unless youwithheld $20k, you'd honestly just be getting your money back.

I don't know why so many families with kids don't choose to exempt themselves. They would receive the child credit, which is usually enough to pay off any tax liability. Instead they withhold ZERO, have huge amounts taken out every paycheck, and then also receive the child credit.

Now in the above example, say you still make $100,000, but are married with two kids under 16. Your liability drops to $4687. Yet so many get back a lot because they aren't adjusting their w-4.

Not many go beyond the $12,200 standard deduction, so your tax lady may have fudged some numbers to lessen your liability. But at the end of the day for so so many, they aren't working magic. You simply witheld too much. Now they may portray it as such. So it's best to sort of know what you make, and what's ultimately owed

It’s a withholding chart that shows you your expected amount withheld under the 3 new scenarios (single/married/HoH)

One does sort of need to predict what you will be making for the entire year. But it’s pretty simple.

I also use an app called taxcaster. For 95% of americans, it's a 2-3 step process.

You have your set yearly income. Subtract deductions and that becomes your taxable income. That gets taxed at different marginal rates. That becomes your federal tax owed amount. One could then divide that by 52, or 26 (or whatever your pay period is) to get an idea of what needs to be withheld.

I don't know why so many families with kids don't choose to exempt themselves. They would receive the child credit, which is usually enough to pay off any tax liability. Instead they withhold ZERO, have huge amounts taken out every paycheck, and then also receive the child credit.

Now in the above example, say you still make $100,000, but are married with two kids under 16. Your liability drops to $4687. Yet so many get back a lot because they aren't adjusting their w-4.

Not many go beyond the $12,200 standard deduction, so your tax lady may have fudged some numbers to lessen your liability. But at the end of the day for so so many, they aren't working magic. You simply witheld too much. Now they may portray it as such. So it's best to sort of know what you make, and what's ultimately owed

Last edited:

so I was gonna end up with less than $600 .. told them I couldn’t afford it and got my stuff back and my dad did it on the computer and got me back close to $1500

so I was gonna end up with less than $600 .. told them I couldn’t afford it and got my stuff back and my dad did it on the computer and got me back close to $1500