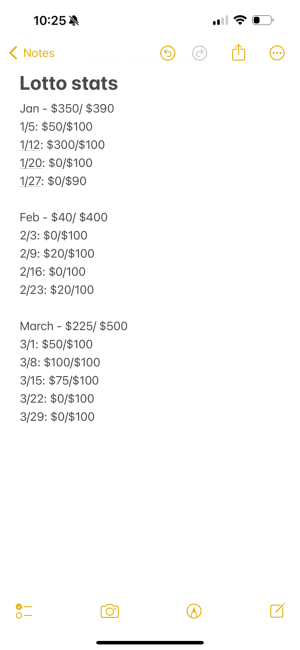

- 260

- 97

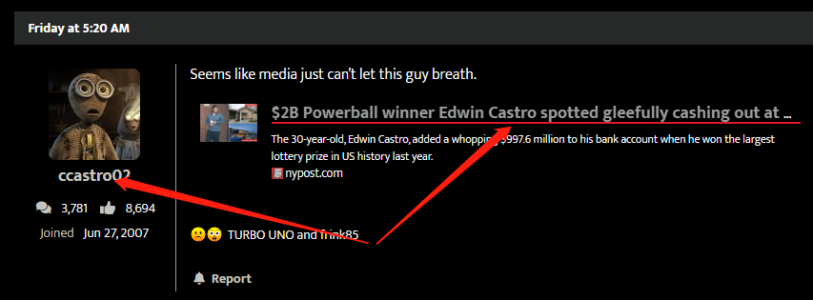

Somewhat True. You can gift unlimited individuals 14k each per yr without it cutting to your estate gift tax limit of around 5 million in your life. After the 5 million the gifter is taxed 40% for every dollar over the limit. The cap will rise in the future because it accounts for inflationYou can only give away $14K w/o it being taxed.

And if you don't pay the taxes on that money then the IRS would surely come after those you gave the money to.

Someone has to pay the taxes, it's usually the gifter, if not then it's the giftee. If not you and your friends would likely go down for felony tax evasion.

Enjoy Club Fed.

.

Facts.

Facts.