- 2,631

- 218

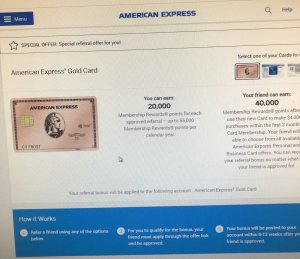

I hope Marriott comes over to Amex.

Everyone is hoping the SPG program doesn't go anywhere but it just doesn't make sense to keep both programs. I'm using most of my SPG points for a couple of nights in Madrid in May. The Marriot card just increased their sign up bonus to 80K if you wanted to apply.