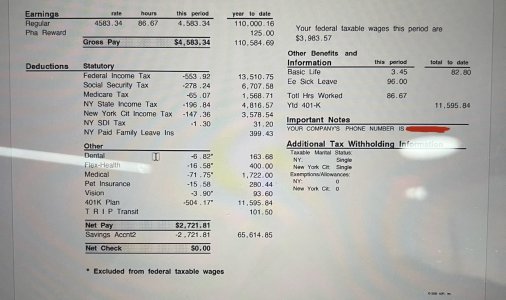

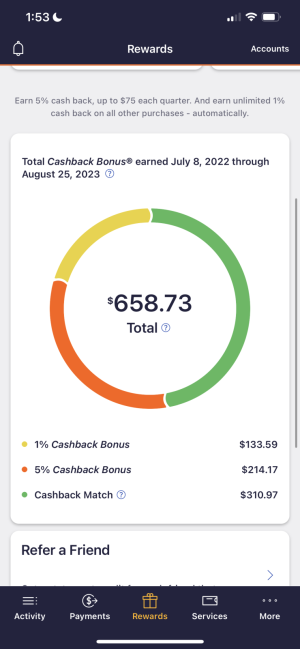

- 3,884

- 131

1. I charge items to my credit card so I'm not liable if there is a problem with my purchase.

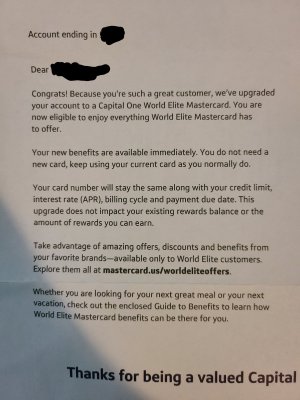

2. It helps build credit, which will help me get a mortgage.

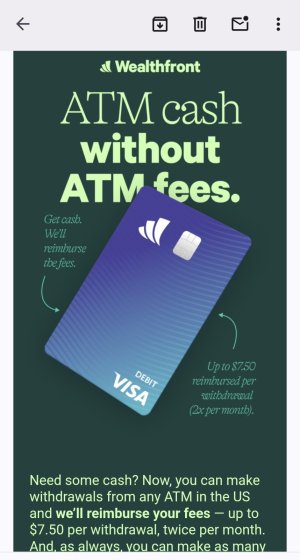

1 - Charging items is a great way to spend 20-30% more than you would with cash. (A debit card with a Visa/MC logo will get you the same exact protection.)

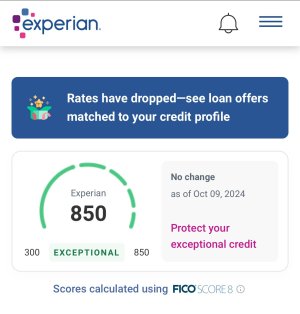

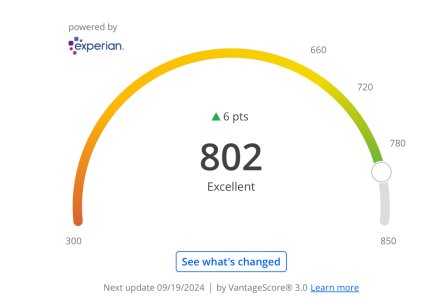

2 - A credit score of 0 with good income and a steady job will get you a mortgage just fine. Just need to use a lender that does manual underwriting