- 3,667

- 2,457

- Joined

- Feb 29, 2008

New to this so bear with me

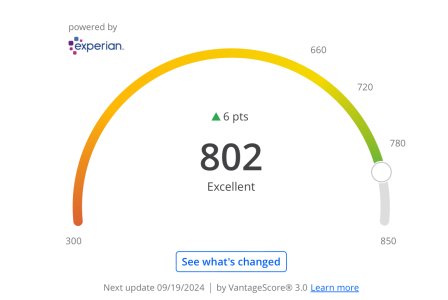

24, want to start building my credit, all I use is my chase debit for everything, what are some good cards to start off with? Capitol One keeps sending me stuff and I hear they are good

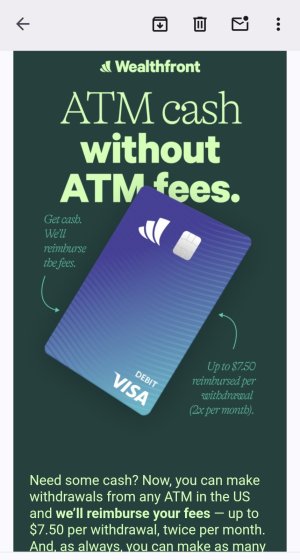

Want to be able to use credit but pay it off immediately, for example i buy something and they take the money out of my checking to pay for it, dont want to pay a big bill at the end of the month

Also is there anyway where I can build credit with my regular bills? I pay my rent online and con ed with my Chase Checking account

Also any other tips for this that will help this beginner is greatly appreciated

A lot of people recommend chase cards or discover it card as beginner cards. Discover it is a great card with some good perks and cash back promos. You can pay any bills that take credit cards as form of payment and it could earn you points or cash back depending on what kind of card you get but paying the bills themselves won't help your credit. If you pay your credit card bill every month on time it will help your credit.