Why would I want the Discover it[emoji]174[/emoji] Miles-Double Miles your first year?

If you want high travel rewards, but aren’t a fan of annual fees, the Discover it[emoji]174[/emoji] Miles-Double Miles your first year is a good option. It boasts no foreign transaction fees, an annual in-flight Wi-Fi credit and an innovative promotional bonus. Plus, miles are redeemable in any amount for cash or travel statement credit.

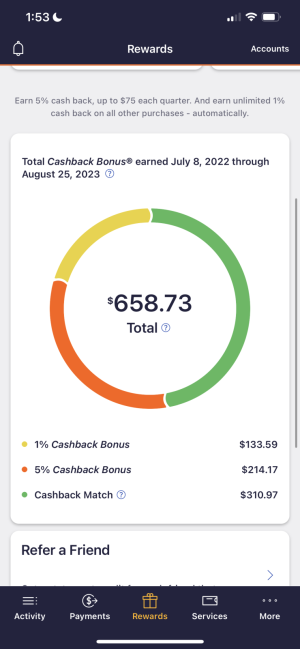

The Discover it[emoji]174[/emoji] Miles-Double Miles your first year offers 1.5X miles on every dollar spent on purchases. There’s not a signup bonus in the traditional sense, but there is a promotional bonus to write home about — the miles you earn in your first year of card membership will be doubled. And after a double take, the Nerdsdouble-checked — there is no cap on this bonus.

You can redeem your miles for travel statement credit on expenses like airline tickets, hotel stays, rental cars, commuter transit and cab fare. Purchase your travel any way you want — directly from the airline or hotel, through a budget travel site or travel agent — and you can redeem with your Discover miles. You can also opt for cash-back rewards via direct deposit if you want.

Frequent fliers will enjoy the Discover it[emoji]174[/emoji] Miles-Double Miles your first year’s annual Wi-Fi credit. You’ll be reimbursed for up to $30 of in-flight Wi-Fi charges each year automatically.

Fee haters, rejoice. Not only does the Discover it[emoji]174[/emoji] Miles-Double Miles your first year have a $0 annual fee and no foreign transaction fees, it also waives the fee on your first late payment. If you do pay late, rest assured that your APR won’t increase. And speaking of APR, the card has an introductory rate of 0% on purchases for 12 months and 10.99% on balance transfers for 12 months, and then the ongoing APR of 11.24% – 23.24% Variable.

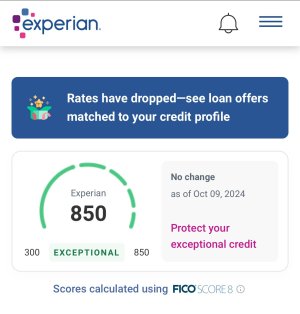

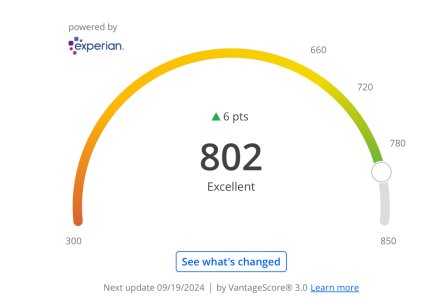

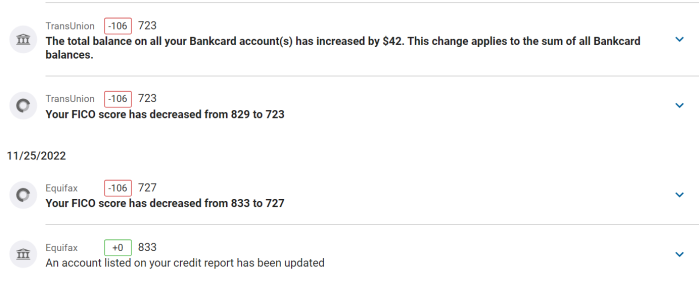

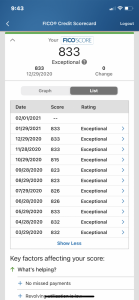

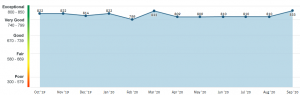

Finally, like other Discover credit cards, you’ll receive your free FICO score on your monthly statements, as well as online and on Discover’s mobile app.