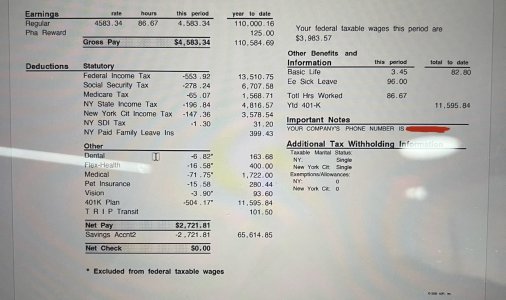

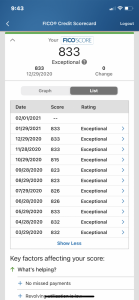

- 11,668

- 13,656

This is a very beginner question, but if someone could help me it would be much appreciated!

So basically I have a question about how the interest acrrues on your balance. With my Discover card my statement ends on the 5th of each month and then the payment is due by the 2nd of the following month. I currently have a 0% APR so I haven't had a chance to answer this question. Basically does interest accrue on the amount that posts as the statement balance on the 5th (ex: I spent $40 during that billing cycle) or interest only taxed on the amount that is left unpaid if any (ex: I only pay $40 of the $50 so $10 is left over on the balance). I only ask because I want to know if I should be paying off the whole balance before the statement ends or can I wait until the statement posts on the 5th then just make sure I pay in full before the 2nd. Thanks a bunch to anyone that helps!

I only use my CC for purchases I have $$ for so this question is just so I know when to pay my balance in full, whether it's before statement cuts or after as far as the interest is concerned.

So basically I have a question about how the interest acrrues on your balance. With my Discover card my statement ends on the 5th of each month and then the payment is due by the 2nd of the following month. I currently have a 0% APR so I haven't had a chance to answer this question. Basically does interest accrue on the amount that posts as the statement balance on the 5th (ex: I spent $40 during that billing cycle) or interest only taxed on the amount that is left unpaid if any (ex: I only pay $40 of the $50 so $10 is left over on the balance). I only ask because I want to know if I should be paying off the whole balance before the statement ends or can I wait until the statement posts on the 5th then just make sure I pay in full before the 2nd. Thanks a bunch to anyone that helps!

I only use my CC for purchases I have $$ for so this question is just so I know when to pay my balance in full, whether it's before statement cuts or after as far as the interest is concerned.