Are you more concerned with your score, or the money staying in your pocket? Chances are your score may drop a little if you pay it off. But you'll be much better financially without those obligations going out each money.

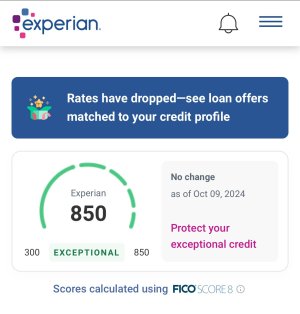

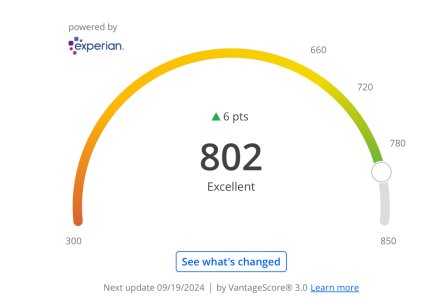

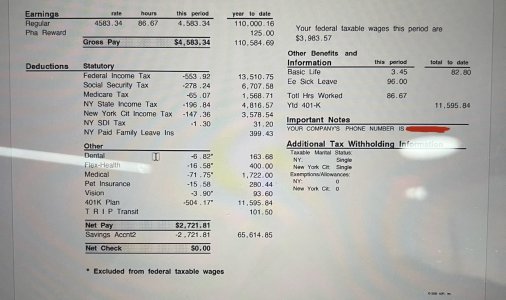

You are a smart man. But I think its very situational. Most are working for a score to borrow for a homr or car. But your score will only affect your rate to a certain extent. Having a perfect score will get you a better rate, but not something that will go past the rate environment. More so, how much you gross and your employment history plays a part as well.

More so, if youve already have a mortgage or loan, I think it makes more sense to be in better financial standing.

And even so, you always want your books to look good. You never want to carry debt. Cash will make you look better, not your ficoh score.