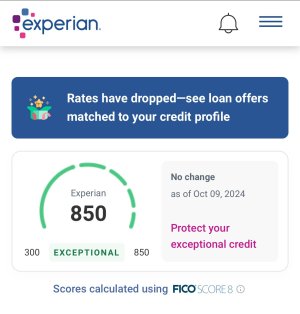

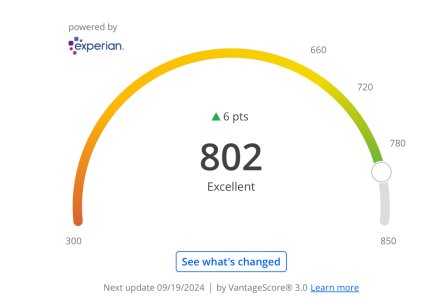

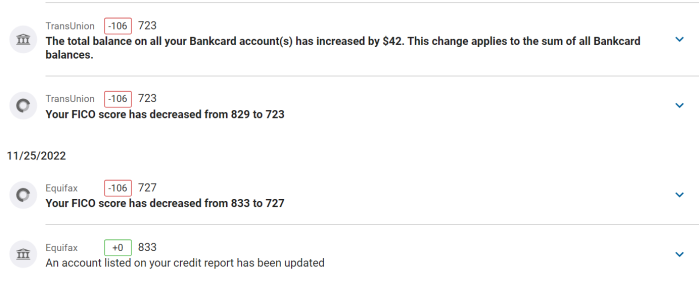

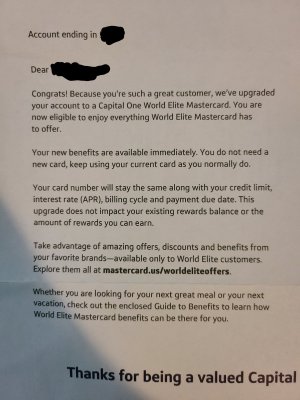

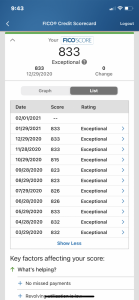

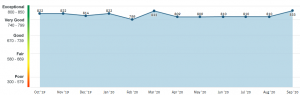

It‘s been talked about already and it‘s kind of common sense. Your credit score is JUST a score. It is in no way an accurate representation of your financial health nor is it a deciding factor in underwriting. If you Prime, you prime. If not, well then that‘s another topic in itself.

People seriously try to do too much.

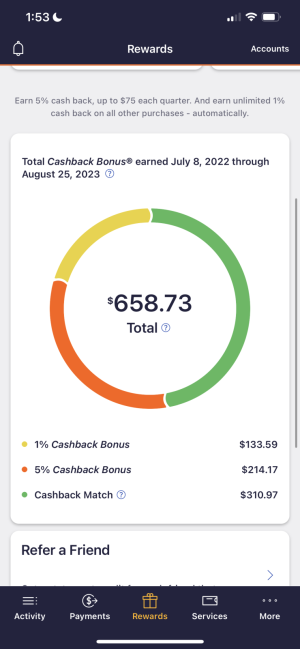

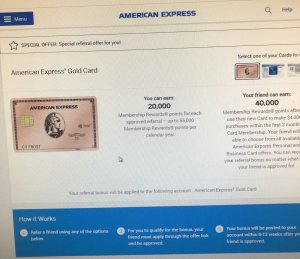

The purpose of a credit card is for convenience. Yet you have people chasing every little dollar as if it means something. You never ever want to finance anything through your credit card. Guys really feel accomplished trying to run 10K in points for a 100 gift card?

As long you have a healthy pattern and you payoff what you spend, you‘ll be in way better position than what a score tells you. Keep in mind, your credit score IS NOT the PRIMARY factor in any underwriting standard.

What hurts your score?

Well common sense things like going into arrears, late payments, that type of thing.

And no, a credit inquiry isn‘t a nuke either. So chill out a bit.

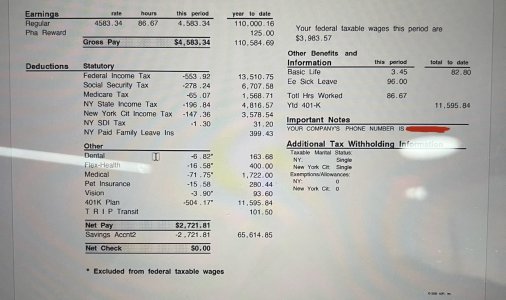

Need money, well look at a personal loan. Still cheaper than a credit card. Your liqudity is the key here, not your available line. No one is fooling nobody here.

These 12-16 month 0% intros are scams. They KNOW for sure, you won‘t be able to pay up as scheduled and sooner or later, you will be caught paying interest.

Live within your means. No need to shame cash and stunt with plastic. As Randy Moss would say, "Straight Cash Homie".

that post was the definition of not reading the post you're quoting