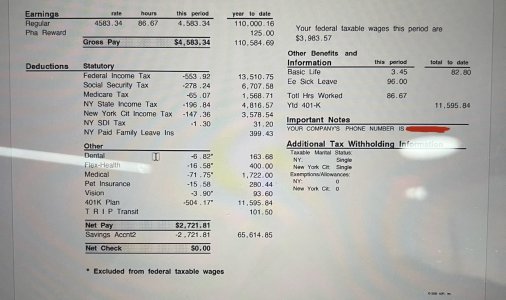

- 4,903

- 1,147

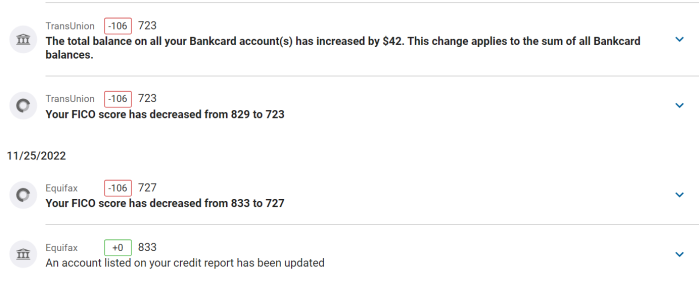

Fuuu I forgot to pay my Cc bill on time

How late are you?

I forgot a couple months back but i was only like 10 days and when i called they said they don't reports until X amount of days i forgot the exact number but i was good. I would pay and give them a call.

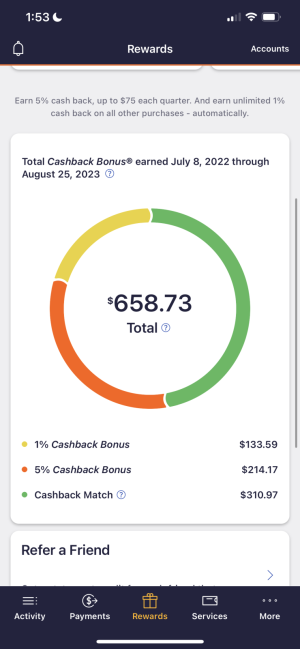

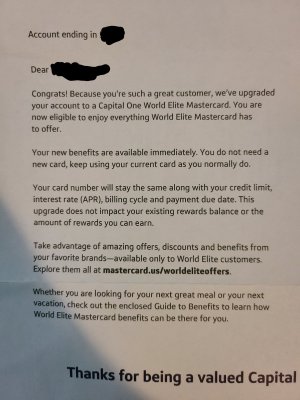

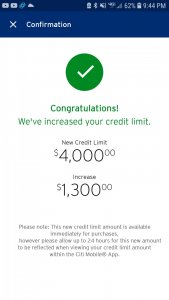

. So my limit has gone up $8,000 in about 4 months since I first got it. I encourage everyone to try your luck if you have the "request increase" button under your credit line when you click "card details" on the homepage of your account.

. So my limit has gone up $8,000 in about 4 months since I first got it. I encourage everyone to try your luck if you have the "request increase" button under your credit line when you click "card details" on the homepage of your account.