- 9,348

- 11,477

- Joined

- Aug 15, 2009

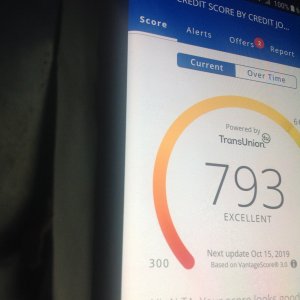

Your Fico score is so low because your have one card maxed out and the other card over 50% utilization. Once you get those balances down you'll see a big jump

Edit: and those high balances are probably why you were denied new credit for those other cards.

No the discover IT doesn't have anything balance on it, all the money is left. The $1700 is due between the other two cards. But thanks on the advice, I'm trying to pay off these balances and chill on spending on my cards for a little

g

g

Guess I'll go with the secured version now.

Guess I'll go with the secured version now.