- 3,096

- 2,206

- Joined

- Jan 6, 2013

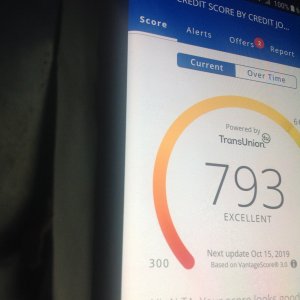

Since it's your first credit card and being new with credit, I'll recommend some no annual fee simple reward cards. If you want look up: Chase Freedom or Freedom unlimited, Amex blue cash everyday, Capital Quicksilver, Discover IT. Those are just a couple of cards that come to mind that are straight cash back or rotating cash back cards. Depending on what you like to spend on you can maximize it a bit more. Mainly high end cards have annual fees and cater to traveling, etc. A credit advice would also be paying your card in full, this helps you not pay a cent of interest so it won't cancel out your rewards and benefits and also of course keeps your debt down.

Hey NT,

I'll be getting my first credit card and was wondering which bank I should use to get the most benefits.

I already have a debit card and an account with PNC but now that I graduated college and got a full-time job, I think its time for me to start building my credit.

Also, any other credit tips would be great since I know NT is filled with experienced people.