- 12,735

- 2,365

- Joined

- Jul 3, 2012

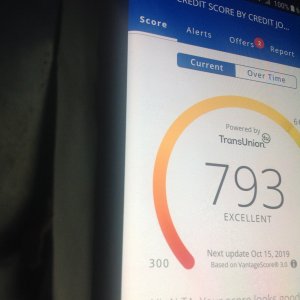

Ok so let me get this then for instance if the total credit card limit is 500$ go into the next month with 0$ or 500$ im just trying to understand cause i always thought 30% utilization was the best...

For building purposes, as well as saving money, it's good to have less than 30% (the less the better) at your statement date. That's the date where transactions for the month are cut off. Your due date is usually about 30 days later. Pay the full balance before the DUE DATE. Otherwise, you end up paying interest, depending on interest rate on the card, you could pay more than you needed

Ok i see what your saying cause im trying to get credit score way up so i was trying to see the fastest way by doing it

@ the credit score increase.

@ the credit score increase.