- 9,092

- 7,285

- Joined

- Aug 30, 2008

Appreciate the support and suggestions fam

All in all, I'm in a tough credit situation but things can be worse. I could have a low paying job, I could be unable to pay my rent, buy groceries, buy a meal, have a car note on top of this, and not be able to do the things I love. I could also not have a family who could help me out (if it comes down to it...I'm not about to take that route tho). So I'm not pulling my hair out..yet. I'm determined to get this **** payed off ASAP because every day I'm realizing what I could be doing with that money that I use to pay these cards off. Grind at work, put that extra OT in, I'll be fine. I got hustler blood and pre workout running thru my veins right now so I'm ready to attack the **** with a 10 lb wooden bat wrapped in barbwire feel me?

All in all, I'm in a tough credit situation but things can be worse. I could have a low paying job, I could be unable to pay my rent, buy groceries, buy a meal, have a car note on top of this, and not be able to do the things I love. I could also not have a family who could help me out (if it comes down to it...I'm not about to take that route tho). So I'm not pulling my hair out..yet. I'm determined to get this **** payed off ASAP because every day I'm realizing what I could be doing with that money that I use to pay these cards off. Grind at work, put that extra OT in, I'll be fine. I got hustler blood and pre workout running thru my veins right now so I'm ready to attack the **** with a 10 lb wooden bat wrapped in barbwire feel me?

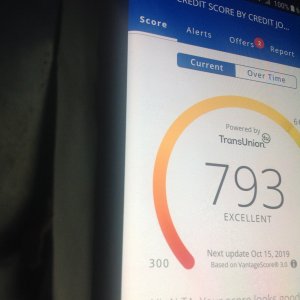

Might need to apply for Amex next.

Might need to apply for Amex next.