- 14,173

- 6,430

- Joined

- Feb 4, 2012

Is showing utilization better? I just feel like it's an old scam banks used to say in the hope people would pay interest.

Yes it's better. If you don't show utilization then it looks like you're not using your credit cards. And you're not understanding that you don't have to pay interest to show utilization. If my statement cuts on the 26th of June, I can leave a small balance on there let's say $10. My due date for that $10 will be the 21st of July. So as long as I pay that full $10 before July 21st, I won't pay a cent in interest and I will show utilization on my credit card. Any money I charge on the card that posts on my account between June 27th-July 26th will show up on my next statement.

I know how a CC work, no need to explain.

But are you sure equifax will assume i'm not using my card if it shows that my balance is 0 when they update my credit? Mastercard know for sure i'm using my card.

Also not using the card = worst for your credit than using it a bit?

How does having a 20k CC and not using is not showing how responsible i am with my credit? It's there and i'm just not using it.

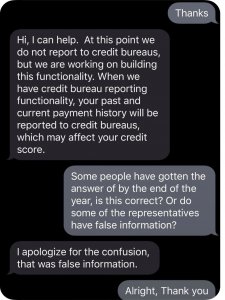

Utilization impacts your score, that's a fact. But a few % of utilization reported on the bureau better than reporting 0%? That's where i'm bugging.

By all means prove me wrong.

that's what I've been saying. I never said wait for the due date to pay. I've been saying let your card report with a small balance on the statement CUT date, then when your statement comes you can pay it off immediately or anytime before your due date and won't pay a dime in interest.

that's what I've been saying. I never said wait for the due date to pay. I've been saying let your card report with a small balance on the statement CUT date, then when your statement comes you can pay it off immediately or anytime before your due date and won't pay a dime in interest.