- 3,667

- 2,457

- Joined

- Feb 29, 2008

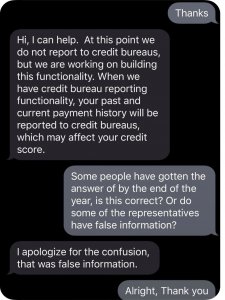

I am 36 now and I got my first credit card at the age of 18 in college. It's the most absolute worst credit card you could get as Capital One preyed on young students. However I still have this Credit Card open till this day and have an auto charge of $9.99 a month and gets paid off. You never want to close your oldest credit card and keep it open. I was taught well by my parents and have excellent credit that ranges from 780-803 these past 7 years. It took me forever to break the 800 mark and it was a smile on my face when I did. I've applied and got things based on my great credit that most people wouldn't. So I'll say its very important in your future endeavors if you don't have an enormous cash flow to fund your purchases/investments.

Bro cancel that card. That's just throwing money away for no reason. Cancelled cards still stay on your report for 10 years. I'm sure you have other cards that will still keep your utilization at a good point

cool.

cool.