- 6,437

- 4,651

- Joined

- Aug 30, 2015

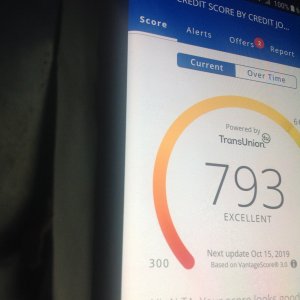

Alright so my credit score is like mad low, around 620, what can I do to raise it quickly? I’ve had a car note for about 3 years now, never missed a payment, never been late on a payment either, other then that I don’t really have any other credit lines that I’ve used. I just recently got a capital one platinum card but I only have a. 300 cl.

I feel like my credit score should be higher especially being the I’ve never missed a payment and never been late either.

Tryna raise it by like 100-120 points in the next 4 months cause I’m trying to buy a new car. Any suggestion? And is that a realistic approach?

The ascension doesn't really work like that, it's pretty slow toiling. Your credit score is low because of your general lack of credit history.

Your score will rise faster than someone with established poor history, but I'd still be skeptical of raising your score above 700 in the next four months.

Depending on who's evaluating your score and for what, deliver a copy of your credit report and explain that you just don't have the credit history to justify a higher score.

In most practical situations you gotta pay to play though. Use that $300 credit line responsibly and you score will rise in a few months. Get a card with a higher limit, rinse and repeat. Be responsible and you wont experience any setbacks.