- 6,437

- 4,651

- Joined

- Aug 30, 2015

FICO Is About To Change Credit Scores. Here's Why It Matters

Credit scores for many Americans are about to change — even if they don't do anything.

The changes will be extensive. About 40 million Americans are likely to see their credit scores drop by 20 points or more, and an equal number should go up by as much, according to Joanne Gaskin, vice president of scores and analytics at FICO, the company at the heart of the credit scoring system.

Personal loans are growing faster than any other consumer debt category; Americans owe more than $300 billion on them. There are all kinds of personal loan offers in the mail, online and on TV. Many promise to lower your interest rate by consolidating credit card debt into a single loan.

For the first time, Gaskin says, FICO is breaking out personal loans as a distinct category to determine whether borrowers use them responsibly.

Why does that matter?

Let's say you pay off all your credit cards with a personal loan. Under the old system, your credit score might go up. But under the new approach, FICO will look back over a period of time — as far as two years — to see whether you've used the loan to reduce your high-interest credit card debt or whether you're using plastic as much as before, running up new revolving balances and falling deeper into debt.

"What we find is that potentially that consumer's credit file carries more risk than what was apparent," Gaskin says.

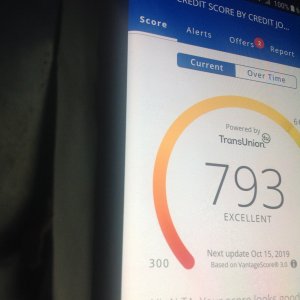

If your finances are in good shape and you already have a good credit score, you're likely to see your score improve, she says. But Gaskin says those whose scores will decline are typically people in the lower FICO score range, about 580 and below. (FICO scores range from 300 to 850.)

That's not good news for people who are struggling financially, says Marisabel Torres with the Center for Responsible Lending. "It sounds like we're penalizing people for getting into a bad situation."

Torres says people who already have low scores are most likely to see their scores go even lower — and that will worsen inequities in the credit system. With personal loans, people with good credit can qualify for good terms. But Torres says predatory lenders charge people with lower incomes very high interest rates.

FICO Is About To Change Credit Scores. Here's Why It Matters

The firm says 40 million Americans' scores will drop by more than 20 points, and a similar number will rise.www.npr.org

Damn. People getting ****ed over just getting the pile on compounded.