- 7,586

- 7,463

- Joined

- Oct 7, 2007

TheRockClapping.gifPardon me if my approach to this is thread is wrong.

In December of 2019, I hung out with my brother in law and we were just talking about finances. He's big on it. I put my pride aside and I picked his brain on financial literacy and freedom. It felt embarrassing to say it out loud, but my credit score was 560. Both my TransUnion and Equifax. I was behind on my cards, had a medical bill pending and another in collections:

Capital One: Balance: $4,000 (estimated) Limit: $3,500

Gamestop Card: Balance $2,800 (estimated) Limit: $2,350

Medical bills: 1K

So I created a spreadsheet of everything I owed, again very humbling, and I went to work. My goal was to increase my score by 100pts by December 2020. No buying sneakers, no buying clothes, no fun. Just paying bills.

When I got paid, I would play a round robin of paying a big chunk to highest balances with the highest interest rate and then make micropayments to the others. I would make micropayments every week. $20 or $50, it didn't matter. I would pay something every week to bring that balance down and keep finance charges at bay. I continued that process and 3 months later I surpassed my goal.

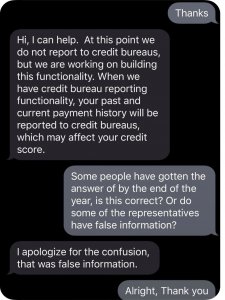

All accounts have a 0 balance and my Equifax is now 710 and TransUnion is at 666 (should update in 7 days, Capital One hasn't reported my 0 balance). I've switched over to a Venture One card from Capital One to gain points in case I use it. All plastic has been locked up. The only time I use a card is my Apple Card and that's because I get cash back. However, I pay it off every week.

My focus is solely on utilization now.

I know ill get approved but want a high limit

I know ill get approved but want a high limit