- 93,999

- 33,025

- Joined

- Oct 24, 2010

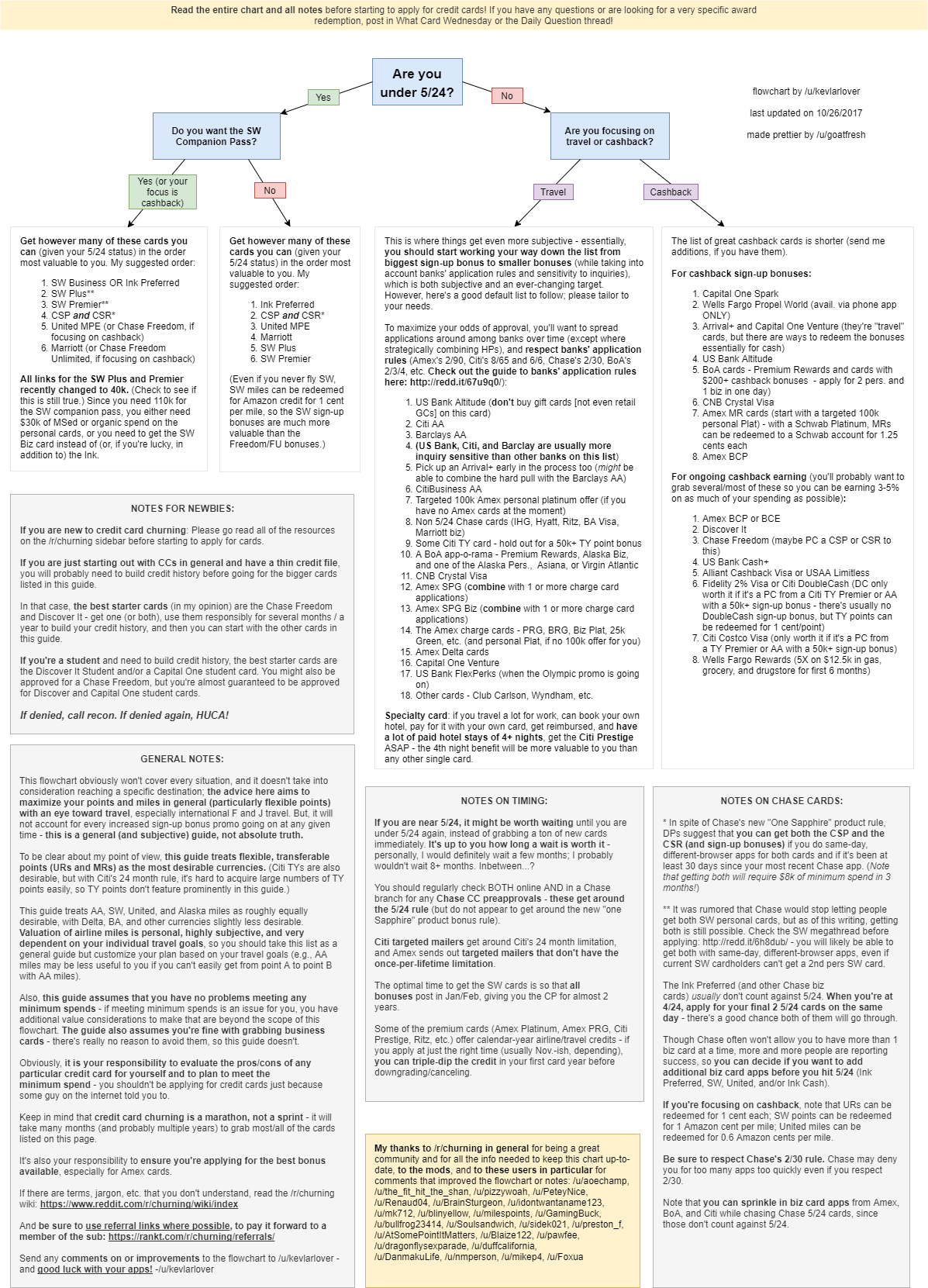

For me, I like Discover better than Amex, capital one etc.

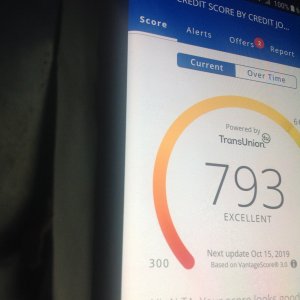

Capital one is a joke. I want to close my account with them but I'm afraid it will hurt my credit score since it's my oldest card and contains my oldest credit history

Don’t close it, just don’t use it

I made 2k+ the past 2 years so now I’m def gonna have to report it

I made 2k+ the past 2 years so now I’m def gonna have to report it