- 94,123

- 33,161

- Joined

- Oct 24, 2010

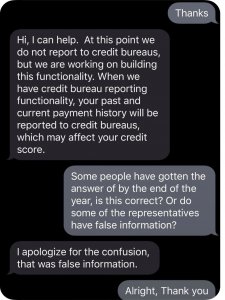

Wait, adding people on cards has an affect right away?

My mother’s score need some boosting and I said to her actually a few days ago I thought of adding her

My mother’s score need some boosting and I said to her actually a few days ago I thought of adding her

C'est la vie tho, not playing on buying a house anytime soon.

C'est la vie tho, not playing on buying a house anytime soon.