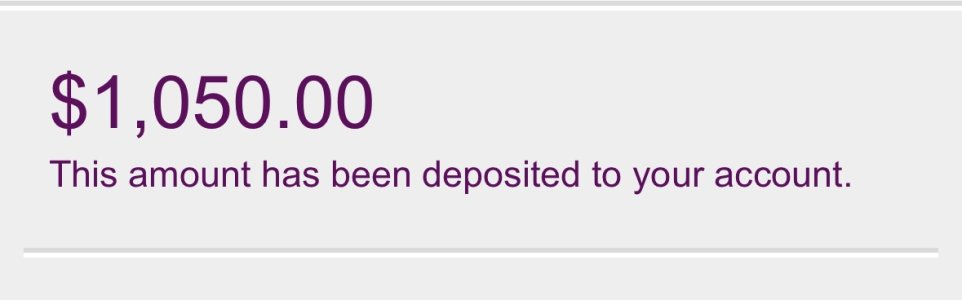

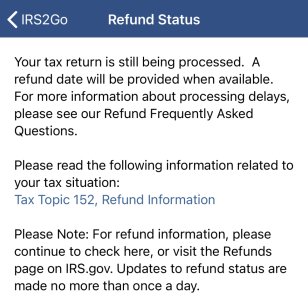

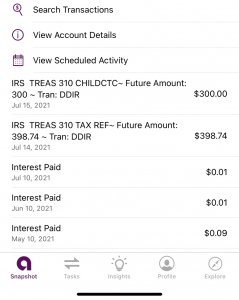

Those awaiting the arrival of the

third stimulus payment, which could

start being deposited as soon as this weekend, will soon be able to track its status on the Internal Revenue Service's (IRS) website.

Like the other two stimulus payments, you can track the status of yours using the IRS's

Get My Payment tool. However, the tool is not available yet for the

American Rescue Plan (ARP) payments, as the IRS needs time to review the law's tax provisions. Treasury officials said Friday evening the tool would be available starting Monday, March 15.