- Jan 4, 2014

- 9,117

- 13,954

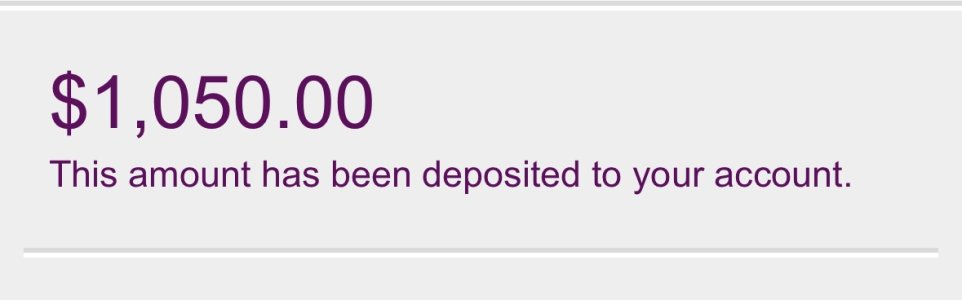

I feel many lie about their tax situations. There’s nothing inherently fishy about someone making $130k and getting a refund. That’s what extra withholding are for. I bet chick is withholding an extra $300/week on top of claiming zero.

And a person earning $120k will have a federal tax liability of $20,047. So one just needs to backtrack from that point and withould the appropriate amount. Those who get a refund, withheld too much of their own money. Those that owe didn’t have enough withheld. By early December, most should have an idea if they will owe or get a refund, so change up that w4 as soon as you can.

A lot of people make it out to be harder than it is.

Add in two kids to the situation above and their liability is $4,000 less. You owe $16,047 over the course of the year. But many don’t change withholding. So they see it as $4,000 in free money.

Not enough single parents nearing the poverty line claim exempt. They’d get their own money when they need it week to week. Instead of looking at it like free money in April.

A mom making $27,500 gets $8,000 in credits each year. So why are they still claiming zero? Their liability is a mere $1700, so they get a nice $6300 refund on top of any extra withholdings.

The government also imposes a penalty if you owe. I’m not sure exactly what that number is. So that’s why many just opt to go over every year and get that refund.

I try to explain this to ppl but the response I get everytime is that they'd rather the lump sum. I'm like you're giving the government an interest free loan and most ppl respond that they'd just blow it if they are getting it week to week. Amazing how bad americans are with money.